As business valuators, we often have to explain some common misconceptions about the value of a business and how business valuations are conducted. Here are the four most common myths we encounter:

Myth No. 1: All Businesses Are Worth What Someone Is Willing to Pay

The myth is in the details, because all companies are really worth what someone is willing to pay, but also – let us not forget – able to pay.

Is this a hair-splitting difference? No, the biggest obstacle to selling a small or mid-sized business is financing. Even well-funded private equity firms want to limit their exposure by making offers contingent on reinvestment by the seller, among other things.

For this reason, the value “on paper” will not be converted into money in your account unless the buyer has the means to purchase the business. What a seller wants, has lower relevance in relative terms.

Myth No. 2: Businesses Can Be Valued Using Pre-Determined Formulas and Standardized Tables of Capitalization Rates

Many business valuators, especially those who choose to comply with third parties rather than the IRS, use standardized capitalization rate tables to calculate the value of a business.

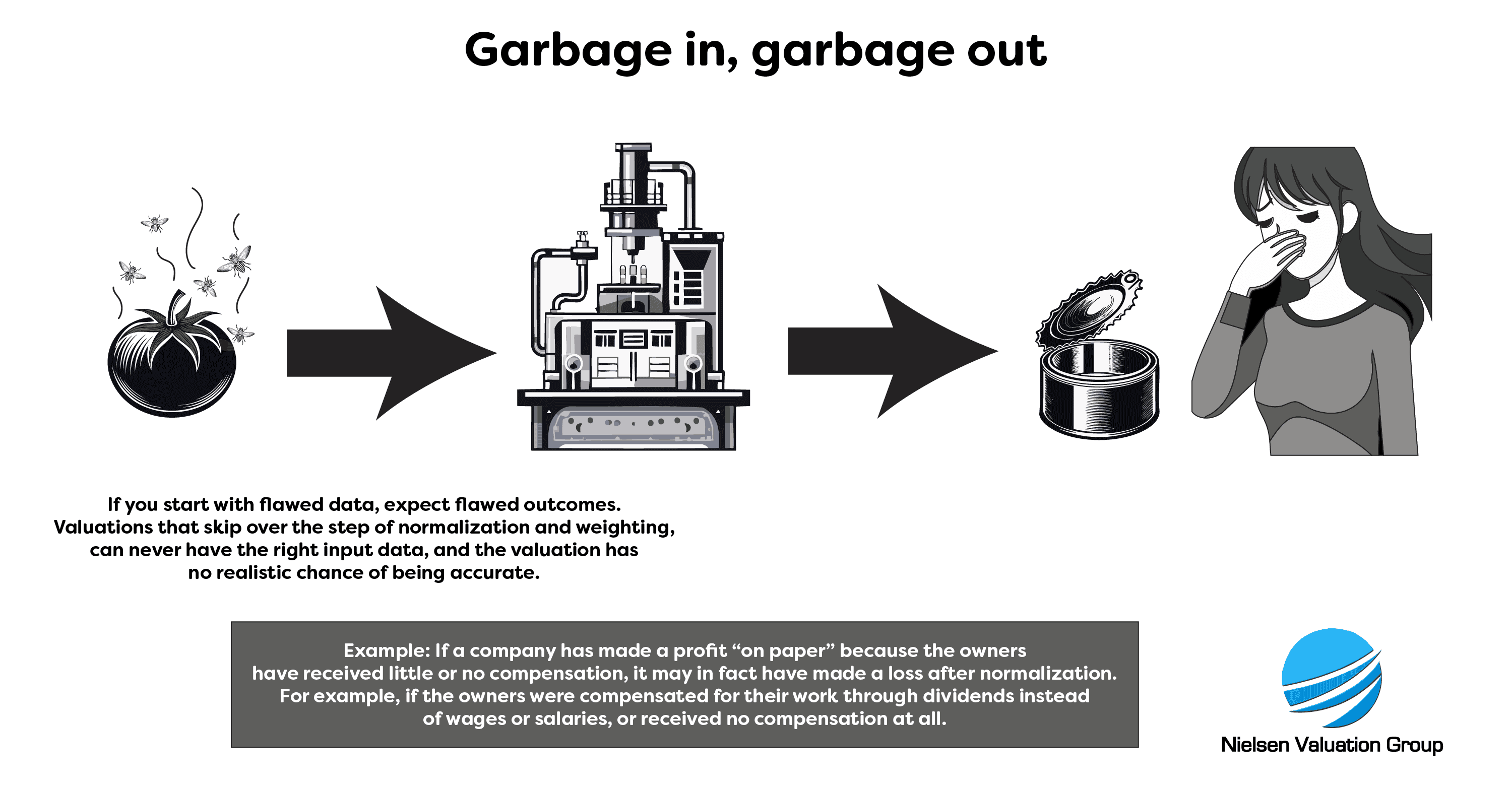

This is not how transactions work in the real world. If your valuation uses predetermined formulas, why not just use any AI tool or a free online calculator? Neither will uncover the details beyond the balance sheet and income statements, such as the real market value of assets or unveiling unrepresentative income or expenses.

You should only pay for a qualified opinion from an expert with real-world experience, not one who uses pre-determined formulas, which, by the way, are prohibited by the IRS.

Myth No. 3: Business Valuations Are Always Precise

Those who use pre-determined formulas generally claim that their valuations are accurate. But those who work with real-world transactions know that business valuations are more like a shotgun than a sniper rifle, meaning that there is a natural spread in valuations.

Startup valuations are more like sawed-off shotguns, with a huge range in valuations. They have an extremely wide spread, almost no effective range, and no useful purpose beyond point blank range, or 12 months worths of projections.

When valuing a business, you have to be humble about the fact that it is an estimate, and the more assumptions you make, the wider the spread.

Myth No. 4: Sellers Get Paid for Potential

If you are selling a business and basing the valuation on the claimed potential as opposed to the verifiable track record, you are either a tech startup or working with an advisor with limited experience in real-world transactions. If you are selling potential, you will generally get paid in potential, such as earn outs or stock in other speculative companies.

Buyers typically pay cash at closing for verifiable and normalized earnings plus normalized net assets.

Studies have shown that many sellers want to be paid for potential. However, almost no buyers want the seller to get all the upside, because that is the buyer’s purpose in the acquisition. The buyers want to be rewarded for the risk they are taking. Those who claim otherwise, generally do not meet with real-world buyers and sellers on a regular basis.

Do You Want to Do an Unbiased Business Valuation?

Contact us today for a free 30-minute initial consultation and quote.