Compliance

Our Valuations Are in Full Alignment with IRS Revenue Ruling 59-60

Our valuations are conducted in full alignment with Revenue Ruling 59-60, the IRS’s authoritative guidance for valuing closely held businesses. RR59-60 does not endorse a one-size-fits-all model.

Our valuations avoid the mechanical application of cap rates and predetermined formulas. Instead, the methodology here is grounded in pragmatic real-world transaction dynamics. Our valuations does not simply comply with RR59-60 — it embraces its intent,

This approach is not only analytically sound but also fully aligned with RR59-60’s stated view that valuation is a process of careful weighing, not formulaic output, or boilerplate models.

While some third-party valuation credentials promote rigid frameworks — including predetermined formulas and standardized cap rate tables such as the Build-Up Method or CAPM — these approaches often oversimplify the complexities of real businesses. Likewise, many valuation reports include lengthy sections on industry trends, financial ratios, or outdated discount studies — often unchanged from one report to the next — such content rarely reflects the specific facts of the business being valued. RR59-60 emphasizes informed judgment, relevance, and a case-by-case analysis.

When generic material replaces hands-on review of normalized earnings, owner dependency, or actual market behavior, the result may appear thorough, but it falls short of the individualized, fact-based evaluation RR59-60 requires. Our valuations intentionally departs from such approaches in favor of a grounded, case-specific, and judgment-driven analysis, consistent with both RR59-60 and the realities of the market.

While commercially incentivized third-party organizations do provide structured valuation frameworks, they do not hold statutory authority, nor do their methodologies override IRS guidance. To date, there is no known legal or regulatory precedent where compliance with a third-party framework has been given priority over RR59-60.

Some argue that it is possible for a valuation to simultaneously comply with Revenue Ruling 59-60 and methodologies endorsed by third-party organizations even when relying on predetermined formulas or standardized cap rate tables. However, we take the position that such an approach is not fully compliant with RR59-60. The ruling explicitly cautions against the use of rigid formulas or universal capitalization models, and this point is emphasized repeatedly throughout the guidance. RR59-60 calls for informed judgment, reasonableness, and the consideration of all relevant facts — a framework that stands in contrast to the mechanical application of pre-calculated rates or standard multiples.

That said, there is clear conceptual alignment between RR59-60 and the Most Probable Selling Price (MPSP) standard. While the language and structure of these two frameworks may differ slightly, both aim to capture a realistic, market-grounded estimate of value — one that reflects what a business would likely sell for in an open, informed, arm’s-length transaction between willing parties. When applied properly, a valuation can be fully consistent with both RR59-60 and the principles underlying MPSP.

Direct Quotes From IRS Revenue Ruling 59-60

The IRS does not endorse using predetermined formulas or standardized tables of cap rates

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

“Depend upon the circumstances in each case. No formula can be devised that will be generally applicable to the multitude of different valuation issues.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

“Valuations cannot be made on the basis of a prescribed formula” … “Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

The IRS endorses using judgement, to form an opinion, and deciding on the cap rate

“The appraiser must exercise his judgment as to the degree of risk attaching to the business of the corporation”

“To form an opinion of the degree of risk involved in the business.”

“Among the more important factors to be taken into consideration in deciding upon a capitalization rate in a particular case are: (1) the nature of the business; (2) the risk involved; (3) the stability or irregularity of earnings”

The IRS endorses using common sense, informed judgement, and reasonableness

“A sound valuation will be based upon all the relevant, but the elements of common sense, informed judgement and reasonableness must enter into the process of weighting those facts and determining their aggregate significance.”

The IRS endorses considering the history as facts and prior earnings as the most reliable guide

“The history of a corporate enterprise will show its past stability or instability, its growth or lack of growth, the diversity, or lack of diversity of its operations, and other facts needed to form an opinion of the degree of risk involved in the business.”

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.”

Internal Revenue Code § 6662 IRS Notice 2006-96

While the opinions of commercially incentivized third parties may be disregarded at the appraiser’s discretion and without the need for justification, the same cannot be said for IRS Revenue Rulings.

If a valuation ignores critical elements of RR 59-60, relies on boilerplate formulas, or reflects a lack of professional judgment, it may constitute negligence or disregard of rules or regulations under Title 26 of the United States Code (26 U.S.C.), also known as Internal Revenue Code § 6662—even in the absence of a substantial or gross valuation misstatement.

While IRS Notice 2006-96 introduces a numerical safe harbor—providing that a valuation falling within 65% to 150% of the correct fair market value may support a finding of reasonable cause and good faith—this range alone is not determinative. It is merely one factor in evaluating whether penalties may apply under Internal Revenue Code § 6662.

Importantly, methodology matters just as much as the final result. A valuation that happens to fall within the 65%–150% range may nonetheless be subject to penalties if it fails to adhere to the principles outlined in IRS Revenue Ruling 59-60. Courts have consistently regarded RR 59-60 as the governing standard for fair market value determinations involving closely held businesses (see Estate of Gallagher v. Commissioner, Estate of Giustina, among others).

Negligence, in this context, includes the failure to make a “reasonable attempt” to comply with established IRS guidance. Therefore, a valuation that falls short of the analytical rigor and professional standards expected under RR 59-60 may expose the taxpayer, preparer, or appraiser to accuracy-related penalties, regardless of whether the final estimate of value lies within the numerical safe harbor.

Form 8275-R should be used when a taxpayer’s position directly contradicts an IRS Revenue Ruling. These disclosure forms allow the taxpayer to openly acknowledge and explain a position that might otherwise be construed as negligent or lacking a reasonable basis.

Precedents / Case Law

J&M Distrib., Inc. v. Hearth & Home TechsIn this case, the U.S. District Court addressed the admissibility of expert testimony regarding the valuation of a closely held business. The defendant challenged the expert’s reliance on Revenue Ruling 59-60, arguing it was inappropriate for the damages calculation. The court disagreed, stating that the scope of Revenue Ruling 59-60 extends beyond estate and gift tax valuations and is applicable in determining the fair market value of closely held businesses in various contexts. This case underscores the ruling’s broader applicability.

Verholek v. VerholekIn a marital dissolution case, the Pennsylvania Superior Court upheld the use of the capitalization of earnings method without applying minority or marketability discounts. This approach was deemed appropriate for determining the fair market value of closely held stock, emphasizing reliance on historical earnings over speculative future projections.

Magarik v. Kraus USA, IncIn Magarik v. Kraus USA, Inc., the valuation dispute centered on the reliability of financial projections versus historical performance. The petitioner’s expert employed a Discounted Cash Flow (DCF) analysis, heavily relying on optimistic financial projections. These projections anticipated a significant increase in net sales, which the company had historically failed to achieve.

In contrast, the respondent’s expert utilized a capitalization of earnings method, focusing on the company’s actual historical performance. This approach involved determining a weighted average net income and applying a capitalization rate to estimate the company’s value. The court found this method more credible, as it was grounded in the company’s realized financial results rather than speculative projections.

The New York Supreme Court concluded that the petitioner’s DCF analysis, based on unachieved projections, was unreliable. It favored the respondent’s capitalization of earnings approach, which reflected the company’s actual financial history.

Dell v. Magnetar

“Accordingly, the trial court’s reliance on them (DCF) as a basis for granting no weight to the market-based indicators of value constituted an abuse of discretion meriting reversal.

“If, as here, the reasoning behind the decision to assign no weight to market data is flawed, then the ultimate conclusion necessarily crumbles as well—especially in light of the less-than-sure fire DCF analyses.

DCF model—as well as legitimate questions about the reliability of the projections upon which all of the various DCF analyses are based”

The Delaware Supreme Court questioned the reliability of DCF models in this case and issued its ruling on that basis.

Legwork v. Padding: The Integrity Gap

IRS Revenue Ruling 59-60 was established to prevent valuation from becoming a formulaic or mechanical exercise. It emphasizes that no fixed formula can replace a “sound valuation based upon all the relevant facts”.

Yet in practice, that kind of valuation is increasingly rare.

Many valuation reports—including those prepared by professionals who may be quick to challenge more hands-on appraisals—rely heavily on pre-written boilerplate, irrelevant financial ratios, and industry summaries that could just as easily be copied and pasted into any other report. These elements are not inherently bad, but when they replace rather than support real valuation work, the result is a document long on padding and short on substance.

Revenue Ruling 59-60 was written with the clear intent of discouraging precisely this kind of formulaic approach. It emphasizes the need for thoughtful analysis, recognizing that no rigid formula can account for the complexities of a closely held business. The Ruling warns against “the use of averages, arbitrary weights, or mechanical rules,” reminding us that valuation is an art informed by facts—not an assembly line process.

True valuation work is time-consuming and deeply judgment-based. It involves:

- When possible, interviewing the business owner (generally not possible in divorce cases)

- Normalizing salaries and discretionary expenses

- Adjusting depreciation schedules to economic reality

- Weighting historical financial results to reflect underlying trends

- Carefully handling intangibles and goodwill to avoid double-counting or misstatement

These are not optional “enhancements.” They are the core of a credible valuation. But they’re often replaced with pages of filler—industry trends, benchmarking data, template commentary—that may look professional but contribute little or nothing to an accurate value conclusion.

A real valuation is constructed from specific, defensible observations upward. A padded report, by contrast, is assembled from generic assumptions downward—draped in language and ratios that may impress a casual reader but do not hold up under scrutiny.

The difference matters. Because when valuation becomes an exercise in aesthetics over analysis, the result isn’t just a bad report—it’s a misrepresentation of value.

Third party compliance

As stated in ASA materials:

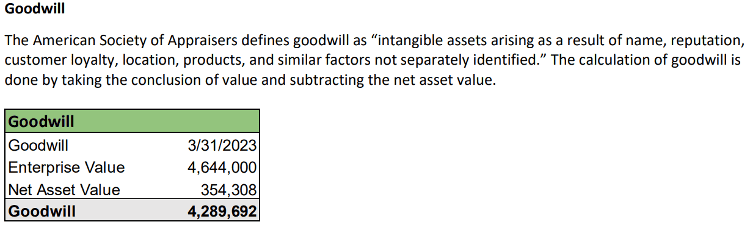

“The calculation of goodwill is done by taking the conclusion of value and subtracting the net asset value.”

IRS Revenue Ruling 59-60 takes a fundamentally different position:

“In the final analysis, goodwill is based upon earning capacity. The presence of goodwill and its value, therefore, rests upon the excess of net earnings over and above a fair return on net tangible assets.”

Under this logic, the more net assets a business holds, the less goodwill it is deemed to have—regardless of the business’s actual earnings power

I explained to my client that goodwill is not a residual figure left over after accounting for net assets, but rather a reflection of the business’s ability to generate earnings.

This methodology disregards the requirements of Revenue Ruling 59-60 and therefore, by extension, fails to comply with the Internal Revenue Code.

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence