Definitions of Value

Common Definitions of Value

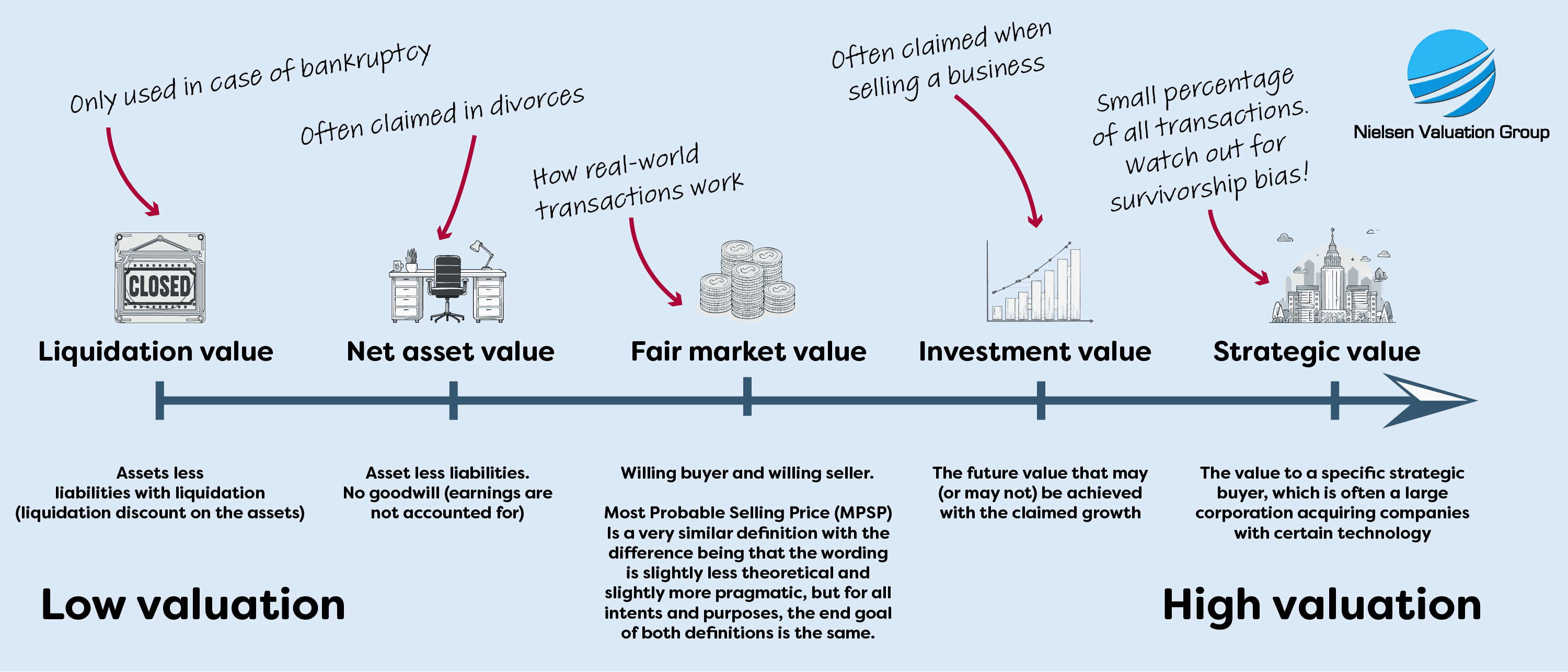

Liquidation value is generally only used in bankruptcies. It is similar to the net asset value, but with a marketability discount.

Net asset value is generally only used to value business without enterprise goodwill or asset heavy businesses.

Fair market value is by all means the only definition that should matter in all business valuations. It includes both a willing buyer and a willing seller. Most Probable Selling Price (MPSP) is a very similar definition as to fair market value. The main difference is that the wording of the definition is slightly less theoretical and slightly more pragmatic, but for all intents and purposes, the end goal of both definitions is aligned.

Investment value includes the upside of the investment, but no willing buyer. It is generally higher than the fair market value.

Strategic value is generally the highest of them all, and it is typical when larger corporations buy smaller companies with certain technology. Survivorship bias is strong here, and strategic value does generally not reflect the valuation of the average sale of an average business.

Revenue Ruling 59-60

“Define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.”

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.”

Survivorship Bias, Projections V. Factually Proven Earnings

It is not common for a real estate seller to ask $15 million today for a property that, based on all the relevant facts, and a willing buyer, is worth $10 million—simply because the property may be worth $15 million five to seven years from now. In the rare event a seller takes this approach, the result is often a failed transaction, as the market typically does not support present-day pricing based solely on speculative future value.

In the context of privately held business transactions, however, this kind of forward-looking pricing behavior is far more prevalent. It is not unusual for sellers to anchor their asking price to projected future earnings or unrealized potential, rather than to what a willing buyer would pay under current circumstances. This mismatch between expectations and market reality frequently contributes to the high rate of failed deal processes relative to successful business sales.

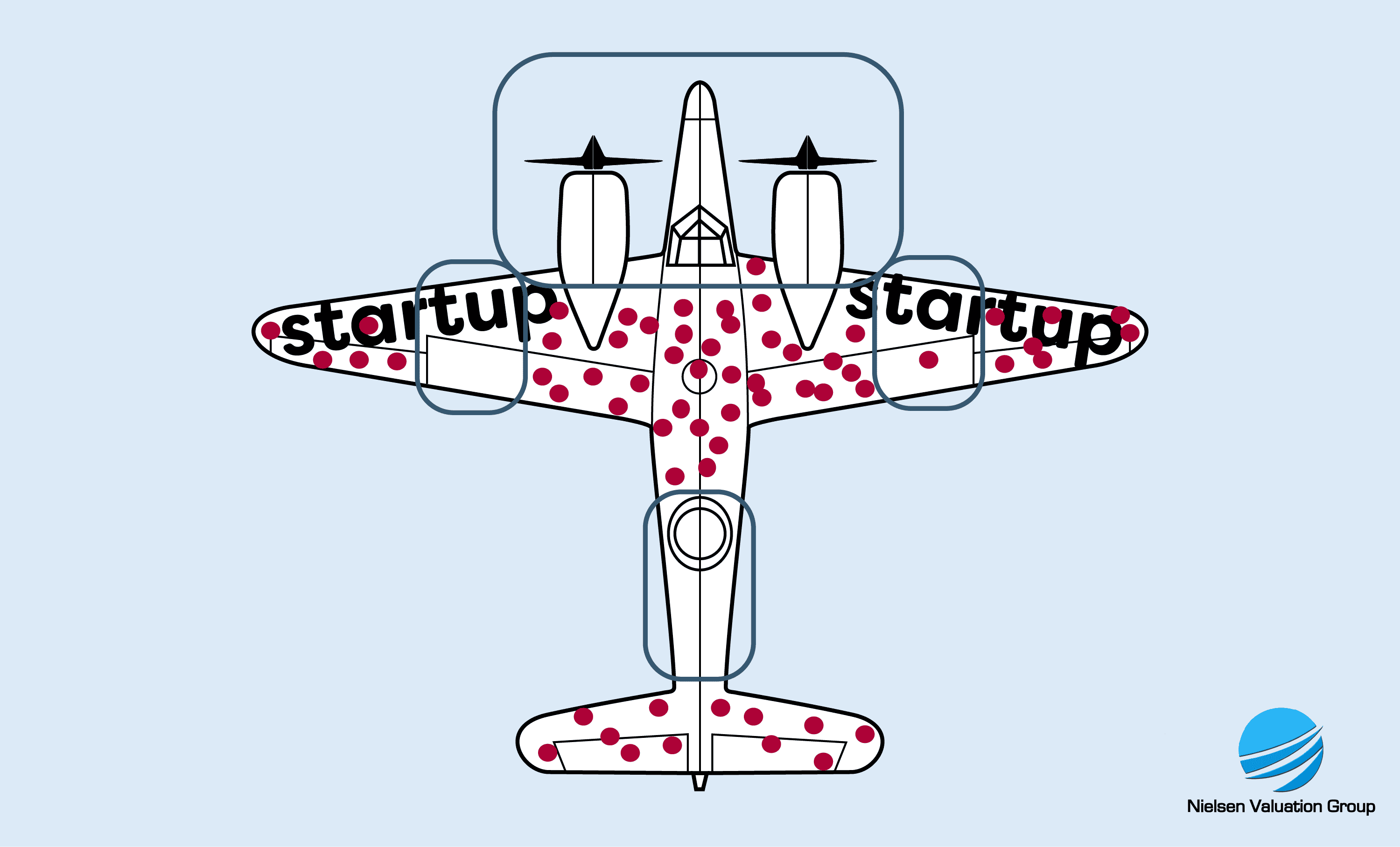

Valuations with a preset formula projects nothing but profit and growth—even when the actual numbers fluctuate between profits and losses, and/or with both incline and decline of revenue. Such projections have survivorship bias.

Template-based valuation models—often used by automated platforms or large credentialing bodies—tend to ignore these nuances. As a result, they frequently generate misleadingly optimistic projections.

In WWII, analysts studied returning planes for damage—until they realized the undamaged areas were where downed planes were hit, exposing survivorship bias.

Risk Assessment

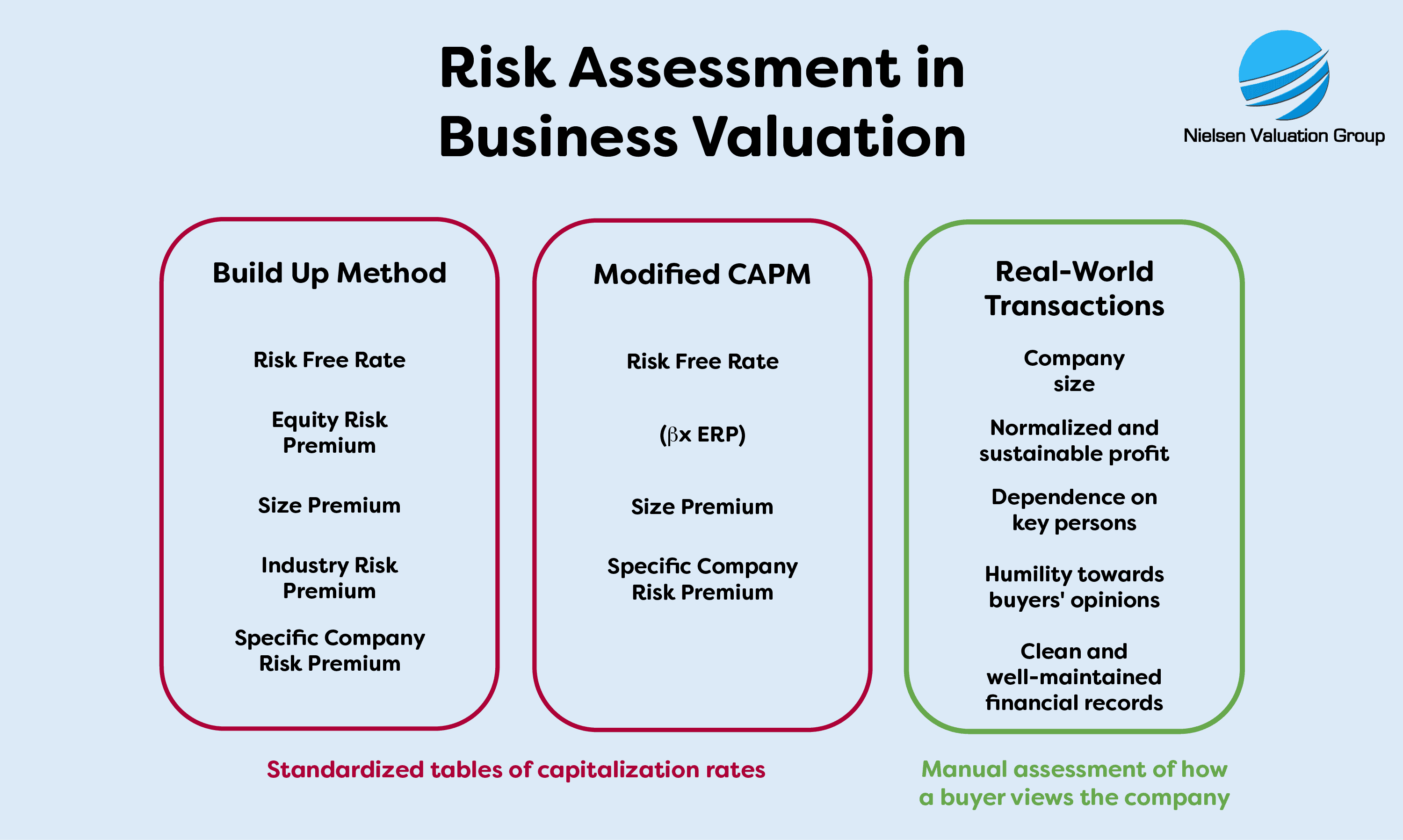

Revenue Ruling 59-60 requires the valuer to form an opinion as to the degree of risk based on the specific facts of the business—not to rely on standardized tables or theoretical models.

“The appraiser must exercise his judgment as to the degree of risk attaching to the business of the corporation which issued the stock…”

“To form an opinion of the degree of risk involved…”

“Deciding upon a capitalization rate…”

“No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

These excerpts underscore the importance of individualized judgment in business valuations, emphasizing that standardized formulas or tables are inadequate for accurately assessing the value of closely held corporations. While the above quotations are drawn from various sections of RR 59-60 and could be viewed in isolation, their consistent repetition across the ruling reinforces the IRS’s clear intent: that risk assessment and capitalization decisions must be grounded in judgment and specific facts, rather than standardized or formulaic approaches.

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence