Your Unbiased Business Valuation in Albuquerque

Business valuations compliant with Revenue Ruling 59-60, designed to reflect real-world transactions

Unbiased Business Valuation in Albuquerque

Nielsen Valuation Group delivers business valuation services to companies in Albuquerque and the rest of New Mexico, prepared in accordance with IRS Revenue Ruling 59–60. Our opinions of value are grounded in actual market data and real transaction behavior, giving you an objective, defendable result – not speculation. Schedule a complimentary 30-minute consultation today.

- We always use the perspective of real-world buyers

- No predetermined formulas

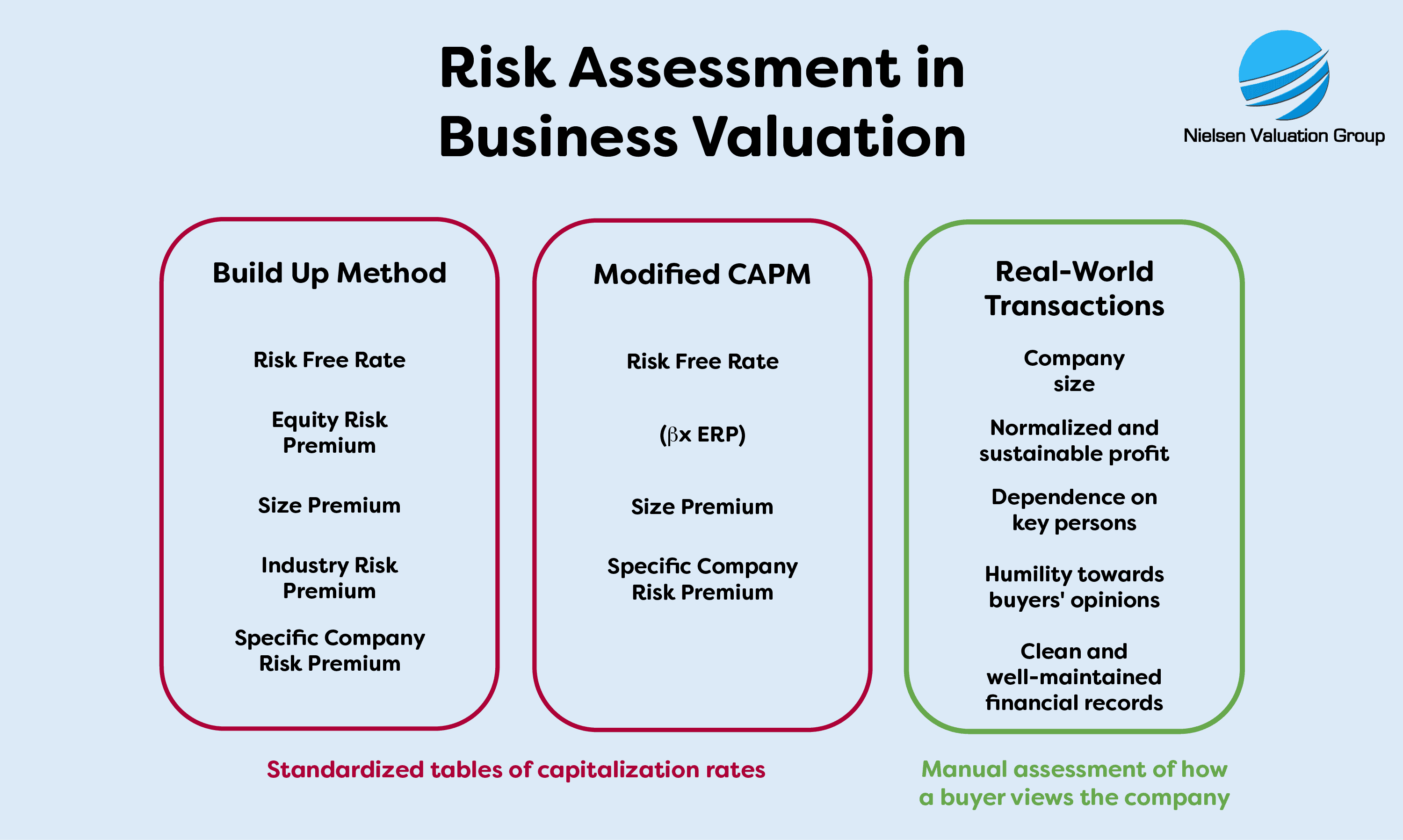

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

Our Business Valuation Offer in the Albuquerque Area

Nielsen Valuation Group provides unbiased business valuations in and around Albuquerque, as well as the rest of the state of New Mexico. Our business appraisals are fully compliant with the Internal Revenue Service (IRS) Revenue Ruling 59-60.

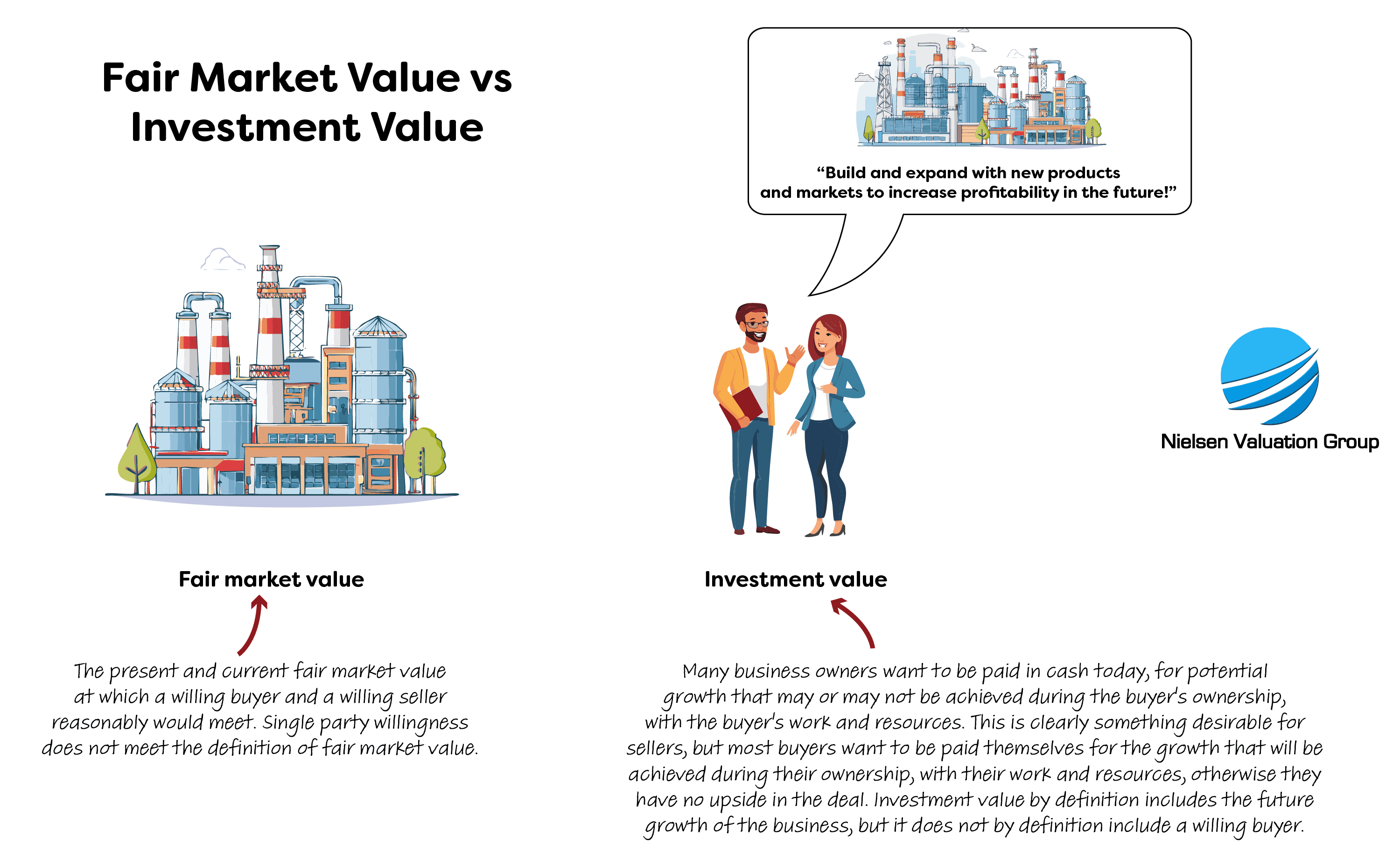

Our purpose is to determine a defendable fair market value that mirrors what real buyers and sellers would agree to—grounded in facts and transactions, not hype or black-box equations.

Our regional presence means we understand the area’s industries and deal dynamics. When helpful, we can tour your facilities and meet stakeholders in person to capture the nuances numbers alone can’t show.

What Does IRS Compliance Mean in Practice?

IRS Revenue Ruling 59-60 lays out how the Service expects closely held business valuations to be performed—thoroughly, thoughtfully, and with attention to each company’s specific facts. Too often, firms in larger markets rely on shortcuts that ignore this guidance.

In plain terms, the ruling underscores that:

- There is no single formula that reliably describes the value for every business.

- Standardized capitalization tables can mislead if they don’t reflect the company’s unique risk, growth, and outlook.

- The business model, earnings quality and stability, and company-specific risks must be weighed carefully in any conclusion of value.

To see how strongly the ruling warns against “plug-and-play” appraisals, consider the language itself:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

We follow the spirit—not just the letter—of this ruling. By anchoring our analysis in the company’s actual performance, risks, and prospects, we deliver valuations that reflect how deals happen in the real world.

Why We Normalize Your Financials First

Every credible appraisal starts by normalizing the financial statements, verifying inputs so the valuation rests on clean, decision-grade numbers.

It’s meticulous work and one of the most time-intensive phases of a quality valuation, which is why it’s often glossed over elsewhere. We don’t skip it.

Our normalization steps include:

- Balance sheet adjustments: Book values rarely equal market values. We adjust assets (and, when appropriate, liabilities) to reflect economic reality.

- Income statement adjustments: We remove one-offs such as asset sales, non-recurring items, and owner discretionary expenses.so earnings reflect ongoing operations.

Only after these adjustments can we credibly estimate fair market value.

No Shortcuts—Only Sound Valuation Methods

At Nielsen Valuation Group, we don’t chase tidy answers from pre-baked formulas. We never rely on predetermined equations to force a number. Complex math can look impressive while masking oversimplification.

Instead, we roll up our sleeves and determine what the business is truly worth by examining what is actually happening inside the company.

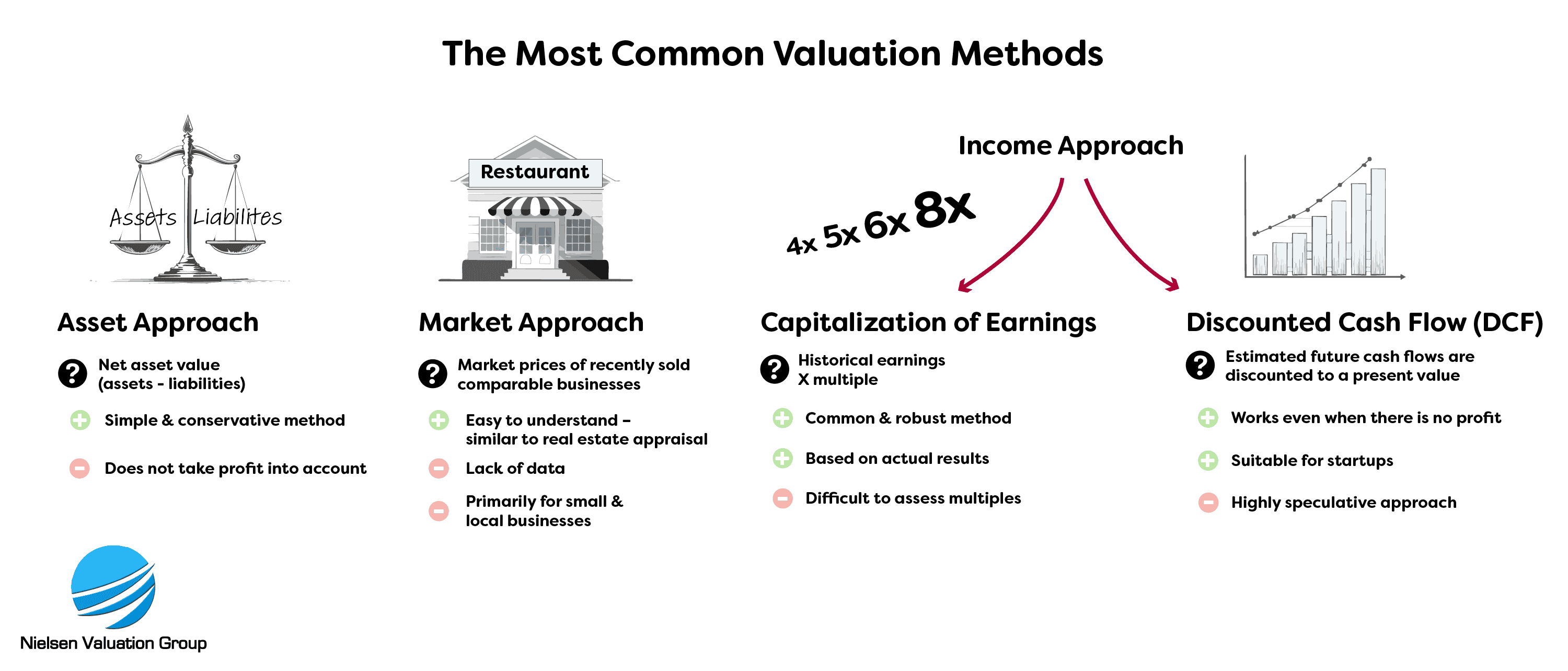

Depending on your situation, we tailor one or more approaches:

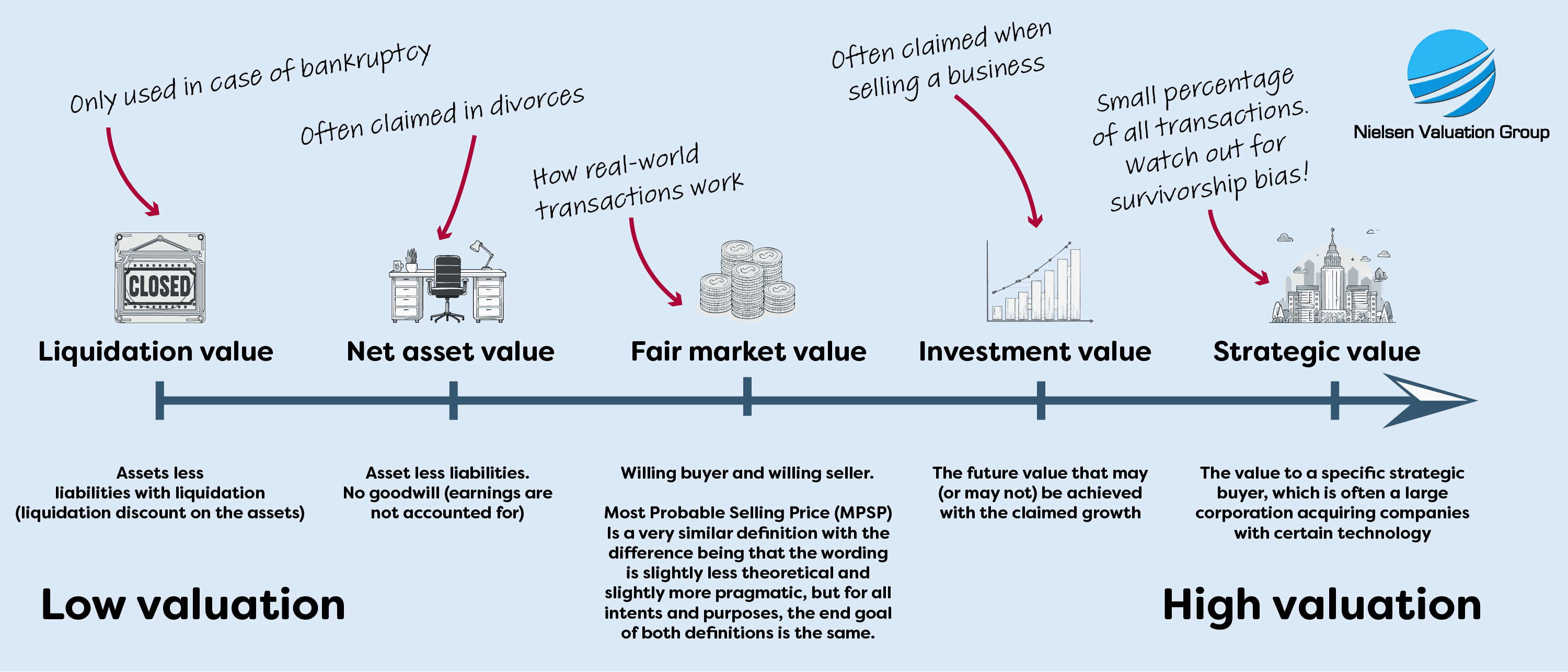

- Income approach: Values the company based on earnings or cash flow.

- Asset approach: Values the enterprise as market value of assets minus liabilities.

- Market approach: Benchmarks against what comparable Albuquerque and New Mexico businesses are trading for.

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.” IRS RR 59-60

We also apply marketability and other discounts when the facts warrant, such as distressed or liquidation contexts, deriving them from the company’s specific circumstances rather than generic academic averages.

Customized Business Appraisals in Albuquerque

Every business is unique. That principle, central to IRS Revenue Ruling 59-60, is core to our process. We do not force a one-size-fits-all template onto your company.

When you reach out, we offer a free 30-minute consultation. You’ll tell us about the business and why you need a valuation; we’ll outline the work required and provide a tailored quote.

Some providers bundle unnecessary analyses and inflate costs. With us, you’re only paying for what you need.

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“ IRS RR 59-60

What Is My Albuquerque Business Worth?

Thinking about selling your business in Albuquerque? We can help you set a price that attracts serious, qualified buyers.

Ultimately, a company’s value is what a willing buyer will pay, not what a spreadsheet shows it’s worth.

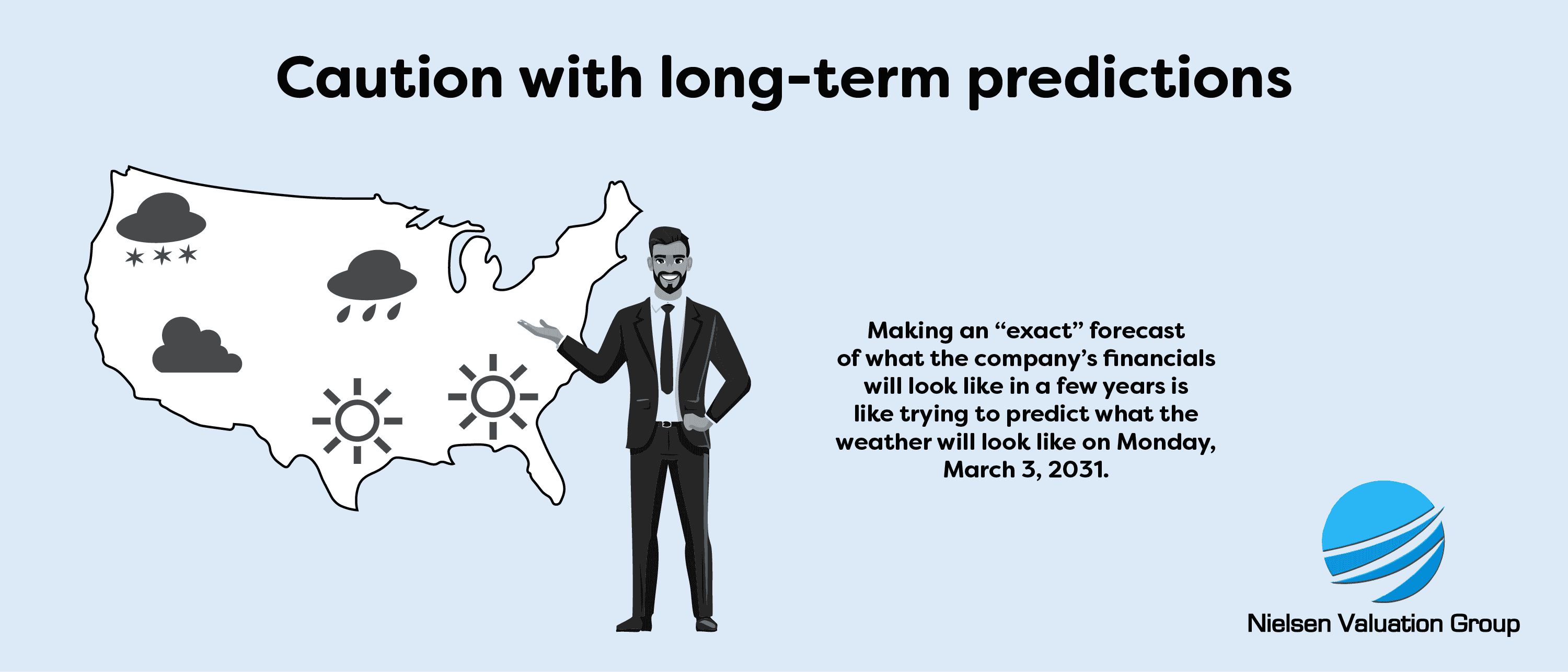

Owners sometimes want the appraisal to reflect untapped upside. In reality, buyers don’t pay cash for potential. They might pay for “potential with potential,” such as shares in another high-risk business, but purchase offers hinge on today’s fundamentals and proven results.

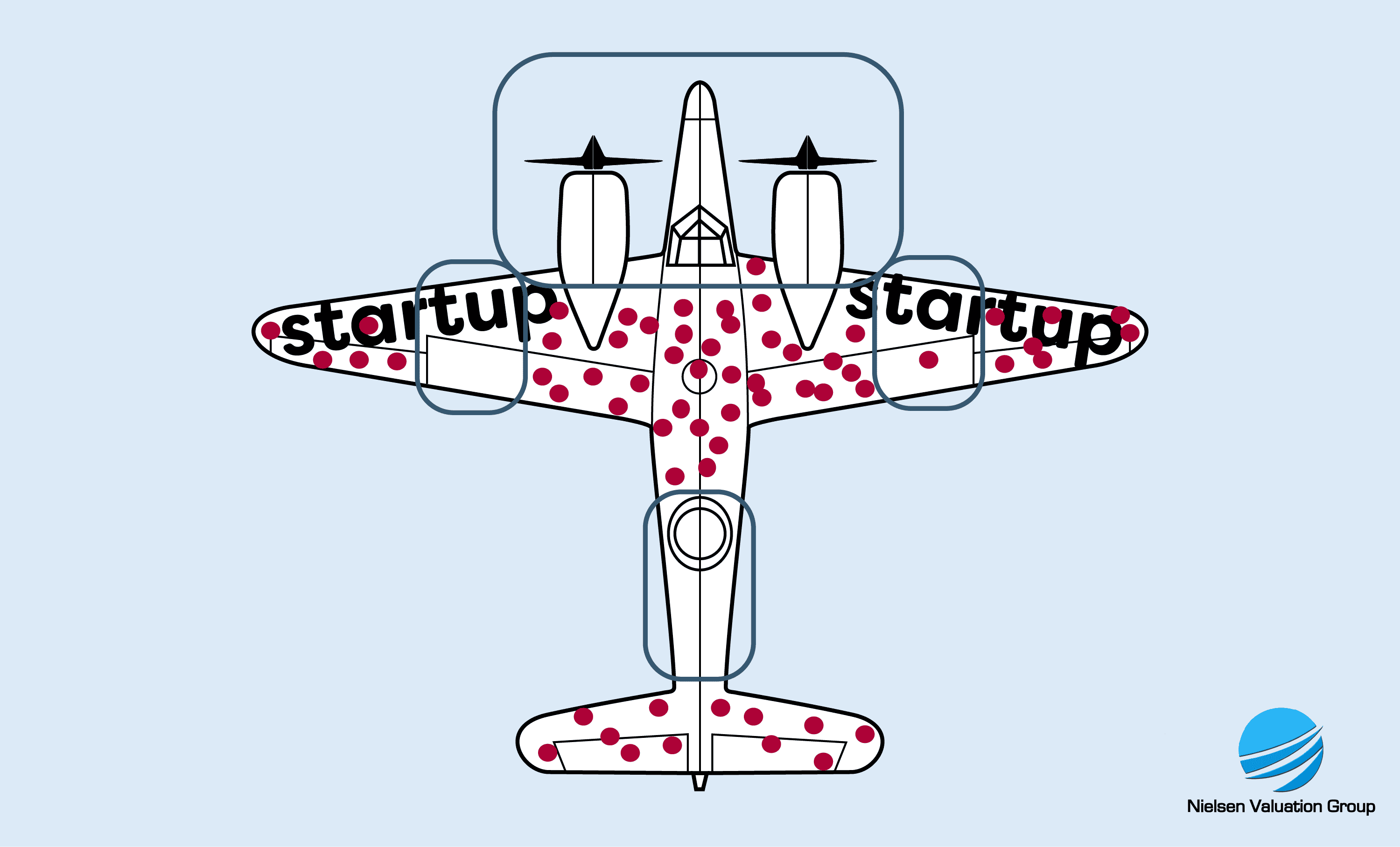

A second pitfall, especially for startups, is underestimating long-term risk. Survivorship bias is real. Pointing to Uber, Alphabet, Tesla, or Meta and assuming a similar trajectory for your own company ignores the many ventures that never make it.

Sophisticated buyers understand the odds and price them in. A balanced, fair market valuation helps you avoid both overpricing and underpricing, and improves your chances of closing.

The classic survivorship-bias story comes from WWII: analysts reviewed returning aircraft to decide where to add armor. Because the cockpits and engines showed little damage, they were deemed “safe.” The truth: planes hit there didn’t return. Many founders repeat this mistake when they focus only on success stories and ignore the unseen failures.

Do You Want to Do a Business Valuation in Albuquerque?

Nielsen Valuation Group delivers unbiased, Revenue Ruling 59-60 compliant Albuquerque business valuations that reflect real-world transactions. Contact us today for a free 30-minute consultation.

FAQ – Frequently Asked Questions

What does a business valuation typically cost?

The cost varies based on your industry, company size and complexity, and why the valuation is needed.

How long will it take to get my valuation report?

Our reports are typically completed within 5 to 15 days. The quote will specify your exact delivery timeframe. If you’re on a tight schedule, let us know — we can often arrange expedited delivery.

Do you appraise every kind of business?

Yes, we do. We provide valuations for all kinds of businesses, with the exception of start-ups.

Can your valuation report be used in court?

Yes. Please tell us at the time of engagement if you plan to use the valuation in court so we can format it accordingly and emphasize the most relevant issues. We have a strong record supporting businesses and individuals in litigation by providing independent valuations. We can present the report in court in Albuquerque, NM if needed.

Do you offer on-site visits as part of the valuation?

Yes, we can visit your business on-site and conduct interviews when needed.

In what situations do you provide business valuation services?

We’re glad to help with any professional business appraisal, with the exception of start-up valuations. Common reasons clients engage us include:

- Buying or selling a company

- Preparing for investments, financing rounds, or M&A

- ESOP valuations

- Partner buyouts, buy–sell agreements, and shareholder disputes

- Business reorganizations, turnarounds, or liquidation analyses

- Divorce-related business valuation

- Insurance coverage and claims

- Tax planning and compliance

- Estate planning, gifting, and probate

- …and many other purposes

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence