Your Unbiased Business Valuation in Miami & Fort Lauderdale

Business valuations that comply with Revenue Ruling 59-60 and are designed to reflect real-world transactions

Unbiased Business Valuation in Miami & Fort Lauderdale

Nielsen Valuation Group provides unbiased business valuation in Miami and Fort Lauderdale, with full compliance with IRS Revenue Ruling 59-60. Our appraisals are based on how real transactions work and reflect the fair market value of the business, free from speculation. Contact us today for a free 30-minute consultation.

- We always use the perspective of real-world buyers

- No predetermined formulas

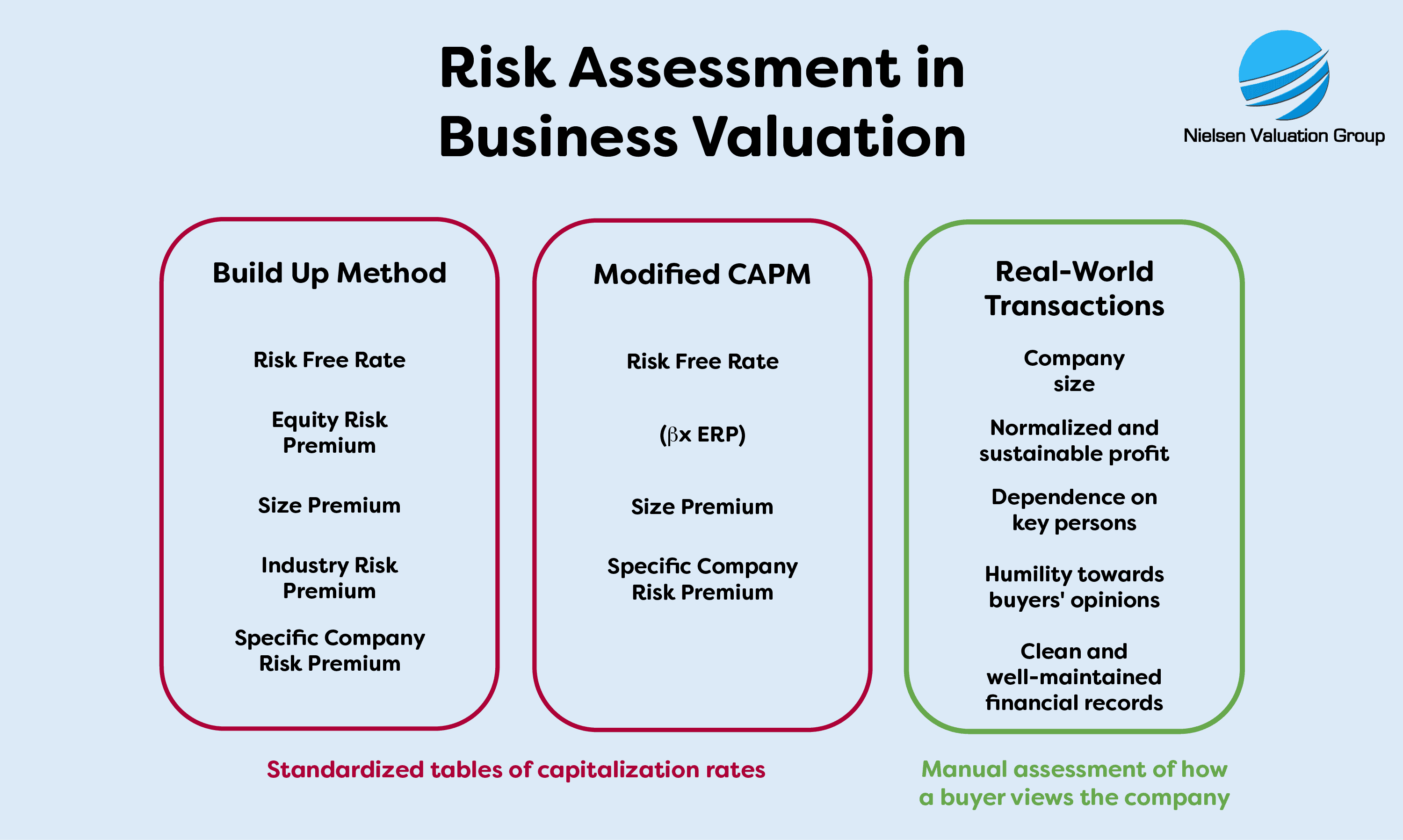

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

What Is Unique About Our Business Valuation Services?

At Nielsen Valuation Group, we pride ourselves on providing fair market business valuation services in Miami and Fort Lauderdale that are fully compliant with Internal Revenue Service (IRS) Revenue Ruling 59-60.

The practical significance of this approach is that the valuation closely reflects how transactions work in the market, as opposed to using speculative formulas or purely theoretical frameworks.

If necessary, we will conduct site visits in Miami and Fort Lauderdale and conduct interviews as well.

For you as a client, this means that you can rest assured that the valuation is realistic. It will help you gain credibility with your counterparts, which has benefits regardless of the situation.

What Does IRS RR 59-60 Compliance Mean?

You would be surprised how many Miami business valuation companies do not even bother to think about the significance of IRS Revenue Ruling 59-60. Instead, they rely on prescribed formulas and oversimplifications that save them time but result in inaccurate value estimates.

For us, this ruling plays a central role in our appraisals. Not only is it an authoritative source, but the ruling also reflects how valuations work in actual transactions. It points out that any assessment must be based on facts.

For example, the ruling is clear on the use of formulas, which unfortunately is a common practice among many appraisers:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

Instead, it points out that the valuation must be done with the specific situation of the business in mind to determine fair market value.

Many appraisers rely on standardized cap rate tables. However, the ruling states that this practice is not acceptable:

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

Nor is the use of arbitrary mathematical weights between different factors in the search for fair market value permitted, as is often the case in many pre-defined formulas. The ruling states:

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

Similarly, it is not possible to simply average earnings in the calculations without taking into account the current situation, trends and prospects:

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.”

These are just a few examples of what the IRS ruling means for business valuations. We make sure to follow the spirit of this ruling in all of our appraisals. We uncover the facts behind the numbers to deliver a solid valuation you can trust.

An Important First Step: Normalization of the Books

Any well-conducted business valuation begins with a thorough normalization of the books to ensure clean data as input.

What does normalization mean? It consists of two parts: Normalization of the income statements and the balance sheet.

- The income statements often contain expenses and revenues that are not representative of the business. For example, there may be one-time payments from the sale of assets, or the owner may have used the business credit card for personal expenses.

- The balance sheet shows the book value of assets and liabilities. However, the market value of assets is often higher than the book value, but sometimes it is lower. There may also be liabilities or assets that are not shown here.

Adjusting the balance sheet and the income statements is an important part of any business valuation. This is how we ensure that the input data is correct. Correct inputs allow us to produce a trustworthy valuation.

Relying on Solid Methodologies, Not Formulas

All business valuations must be based on one or more methodologies. This is not the same as using formulas. Any use of predetermined formulas must be avoided.

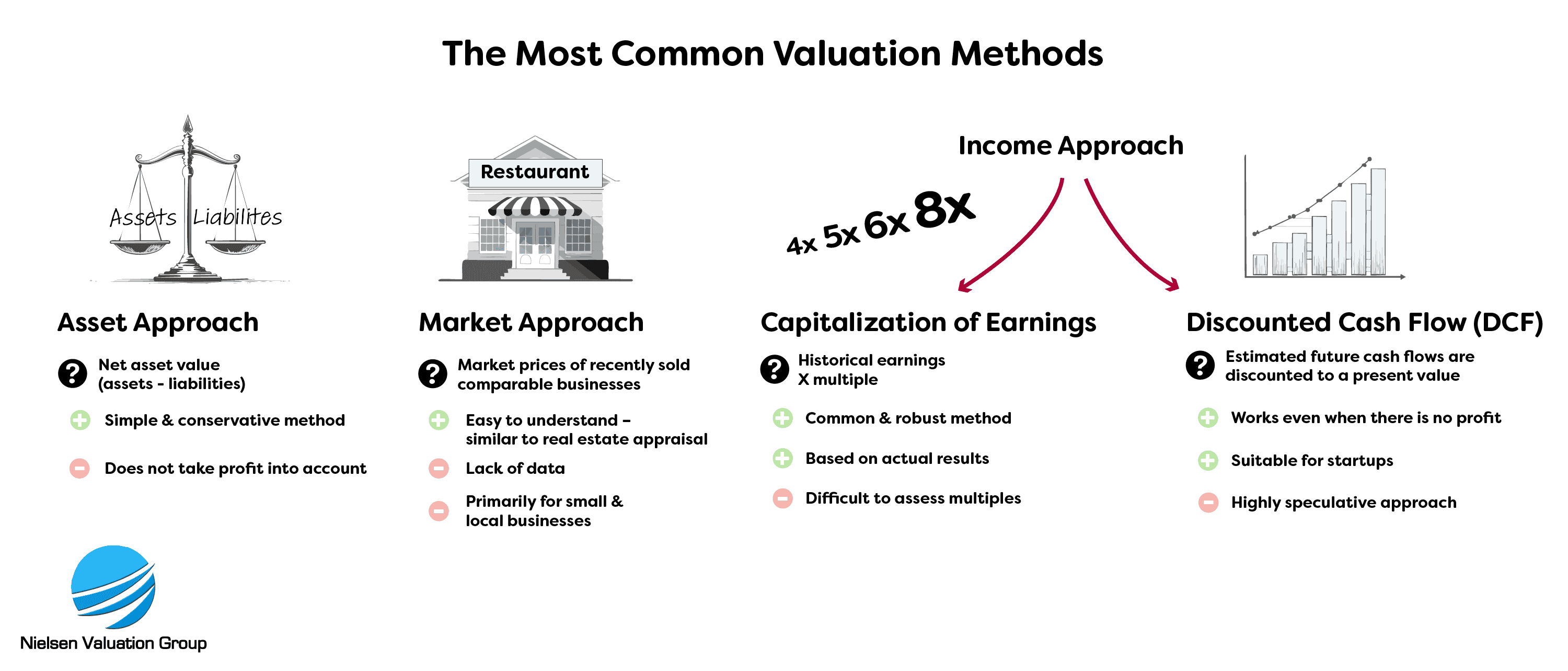

There are three main approaches to choose from:

- Asset approach: Valuations based on the net market value of assets after deducting liabilities.

- Income approach: Valuations based on cash flow or earnings.

- Market approach: Compares what other similar businesses in the area have sold for.

We select our approaches based on the situation and type of business. Often this means a combination of the income approach and the asset approach.

Again, we never use pre-determined formulas or rely on standardized tables of capitalization rates. Instead, we evaluate the business in detail and make our own calculations based on the facts on the ground.

When a discount rate is required, such as when valuing a distressed company or a company in liquidation, we base the calculation on real market transactions. We do not use references that are purely theoretical.

100% Tailored Appraisals in Miami and Fort Lauderdale

Nielsen Valuation Group covers all of Miami and Fort Lauderdale as well as the rest of the state of Florida. Each business valuation is unique.

We offer a free 30-minute consultation which is a great opportunity for you to tell us a little about the business to be valued and ask any questions you may have.

After the consultation, we will provide you with a customized proposal. We firmly believe that you should not pay for services you do not need. That is why we tailor every valuation to your specific needs.

How Much Is My Business Worth?

Are you thinking of selling your business in Miami or in Fort Lauderdale? With a business valuation from Nielsen Valuation Group, you will increase your chances of finding the right buyer.

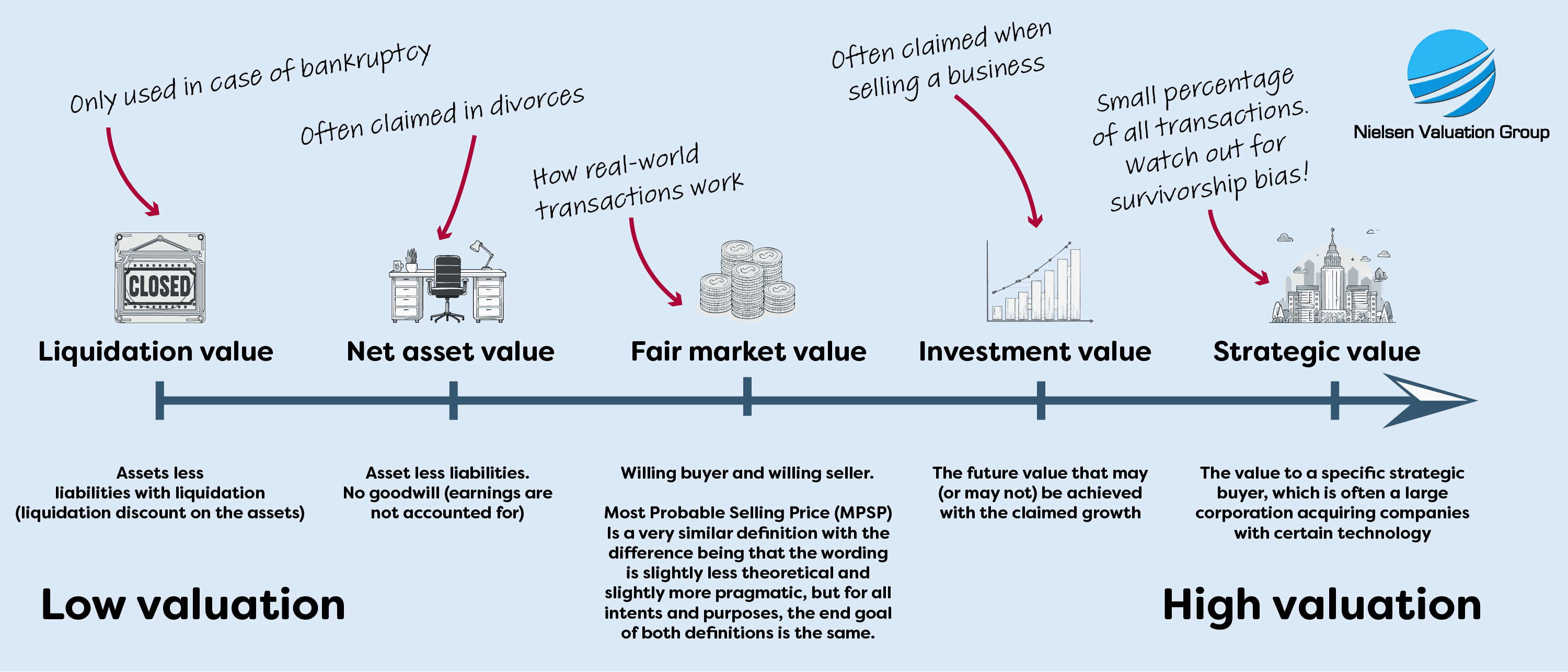

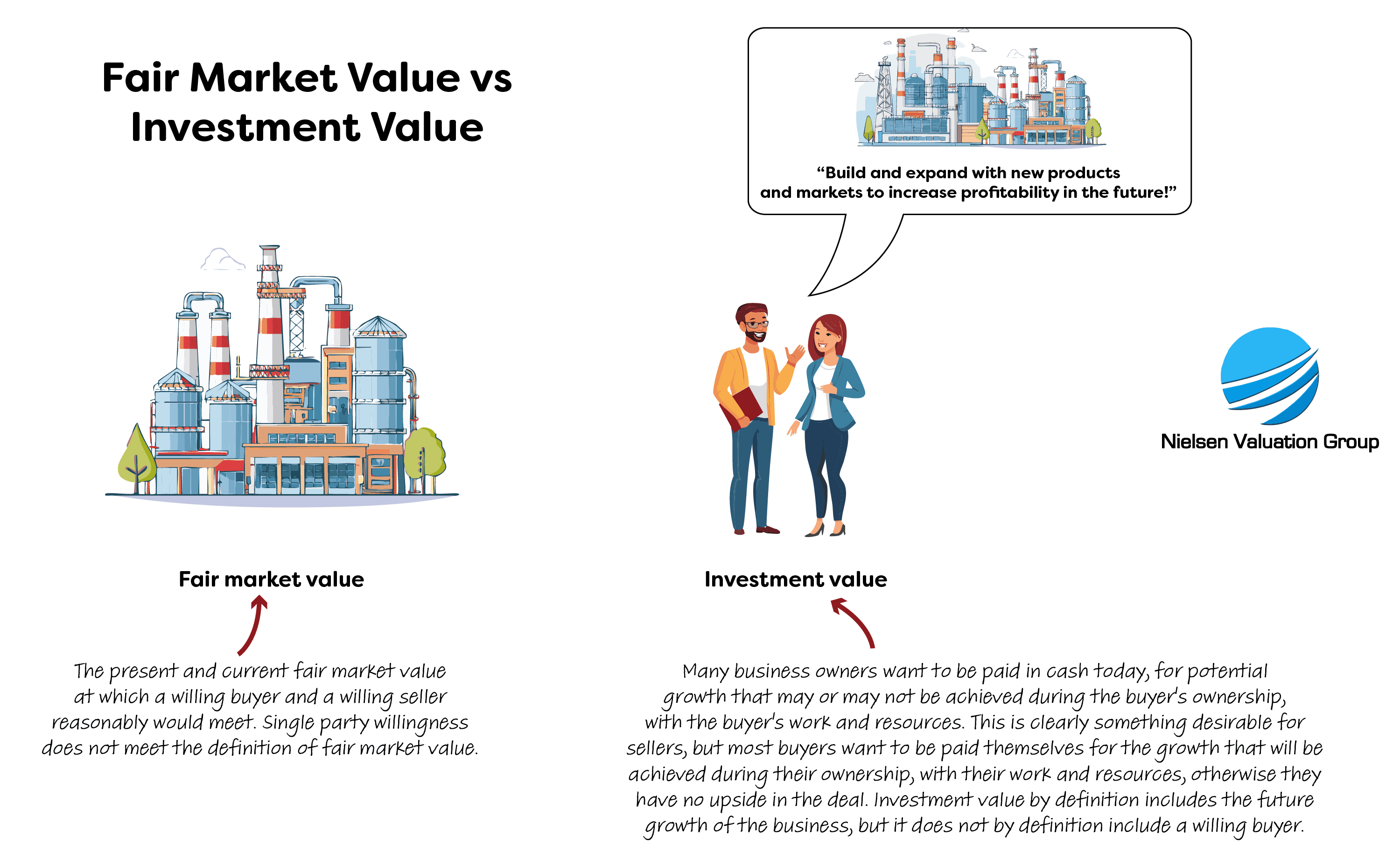

The value of a business is not what someone theoretically calculates on paper. Value is what someone is willing to pay for it. That is why our appraisals strive to find fair market value, not speculative valuations.

If you overvalue your business, you will not find a buyer. If you undervalue it, you leave money on the table. You need to find the perfect middle ground.

We see two common mistakes made by sellers that prevent them from selling their business.

- One is about potential. As a seller, you might want to point to all the unrealized potential there is in the business. But a buyer will not pay for potential. He or she will pay for the proven track record and fair market value of the business. The untapped potential is the upside of their investment, compensation for the risk they will take on their shoulders and the time they will invest.

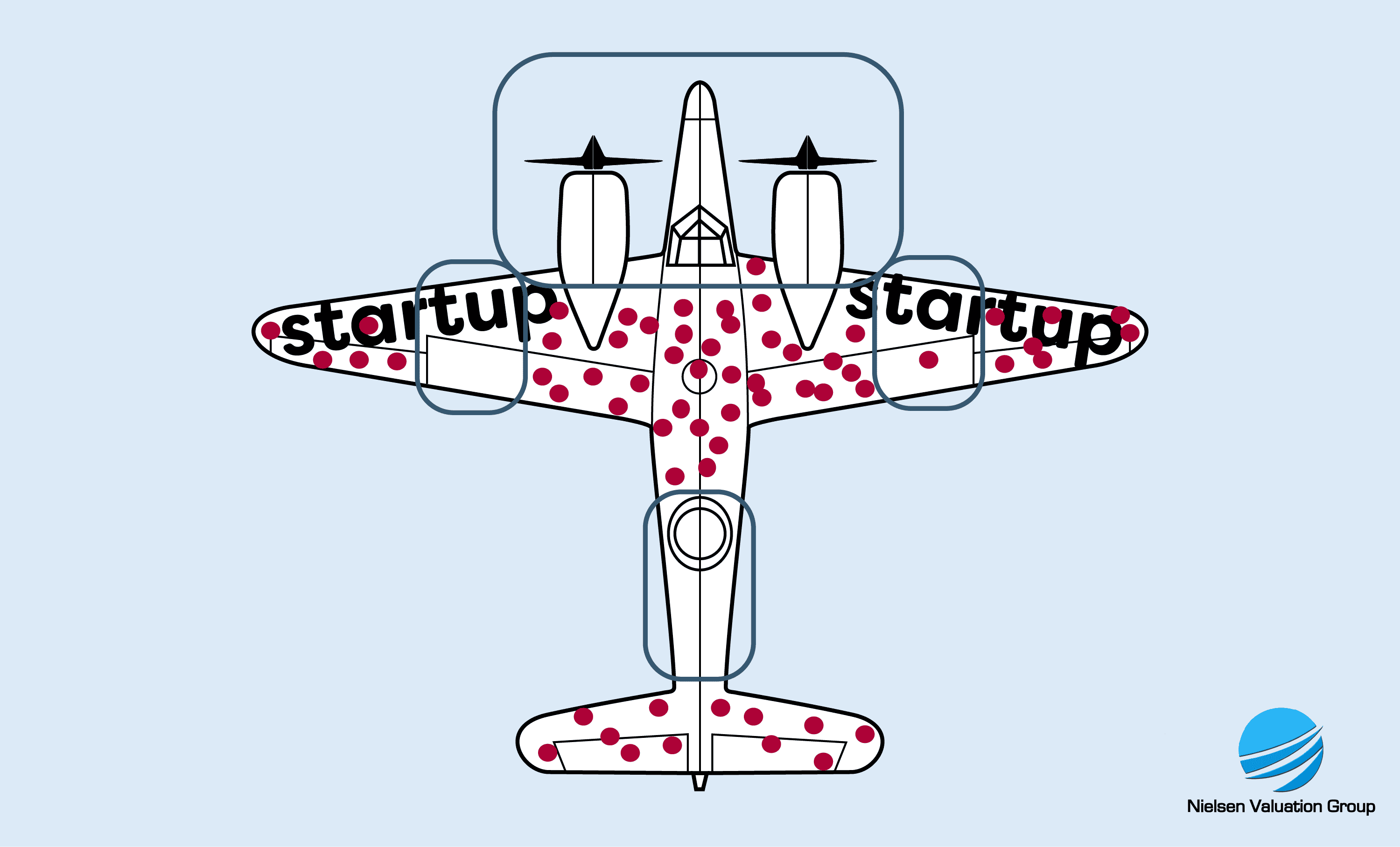

- The other is underestimating the risk. Owners of startups and small businesses often have what is called a survivorship bias when looking at the prospects of their business. They point to successful companies like Uber, Telsa, Meta or Alphabet and reason that their business will follow a similar trajectory. However, buyers and investors know that only 1 in 10 startups survive in the long run, a risk they must consider when making an offer, adjusting the price they are willing to pay accordingly.

Understanding how buyers think and what the fair market value of your business is will increase your chances of selling.

The term “survivorship bias” comes from World War II, after analysts misinterpreted the damage to planes returning to base. They saw that the planes had not been hit in the cockpits and engines, and therefore did not need armor reinforcements in those areas. In reality, many planes were hit in those areas, but crashed as a result. By studying only the survivors, false conclusions were drawn. Today, many startup owners make a similar mistake when estimating the chances of their company’s long-term success.

Do You Want to Do a Business Valuation in Miami or Fort Lauderdale?

We offer a Revenue Ruling 59-60 compliant and fully unbiased business valuation in Miami and Fort Lauderdale, reflecting real-world transactions. Contact us now for a free 30-minute consultation.

FAQ – Frequently Asked Questions

How much does a business valuation cost?

The price depends on the complexity of the business being valued and the type of valuation. A verbal valuation is the least expensive option, while litigation or transactional valuations require more in-depth analysis. Contact us now for a customized quote.

How long does it take to get a valuation report?

In most situations, your business valuation consultant will deliver the report within 5 to 15 business days. Please let us know if you are in a hurry. We may be able to offer a faster turnaround.

Is it possible to use the business valuation in court?

Yes, it is. We have successfully helped businesses and individuals with business valuations for litigation and other legal matters. Please let us know when you place your order that you intend to use the report in court and we will ensure that it is tailored to that end. We can also present the results in court if necessary.

Do you value any type of business?

Yes, we do all types of valuations except for startups.

What areas in Miami do you cover?

We cover the whole of Miami and Fort Lauderdale, including but not limited to:

- Miami Gardens

- Miami Springs

- North Miami

- West Miami

- Miami Shores

- North Miami Beach

- Miami Beach

- Miami Lakes

- Downtown

- Brickell

- Coral Gables

- Wynwood

What types of business valuation services do you provide in Miami FL?

We provide all types of Miami business valuations for all kinds of businesses except startup companies. Our valuations are used in various situations such as:

- When selling or buying a business

- Buy-sell agreements

- Partner buyouts

- Liquidation or restructuring

- ESOP

- Partner or shareholder disputes

- Strategic planning, investments, M&A

- Divorce

- Litigation

- Insurance matters

- Estate planning

- And more!

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence