Your Unbiased Business Valuation in Austin

Business valuations that comply with Revenue Ruling 59-60 and are designed to reflect real-world transactions.

Unbiased Business Valuation in Austin

Need a business valuation in Austin? Make sure it is completely unbiased. At Nielsen Valuation Group, we are fully IRS compliant. We provide accurate and reliable appraisals, free from bias and speculation. Contact us today for a free 30-minute consultation.

- We always use the perspective of real-world buyers

- No predetermined formulas

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

What We Offer in Austin

Nielsen Valuation Group offers fair market business valuation services in Austin TX.

We pride ourselves on providing well-researched and unbiased business appraisals that are fully compliant with the IRS Revenue Ruling 59-60.

We strive to find a credible fair market value for the business, as opposed to using speculative formulas that only create “value” on paper.

We have a local presence in Austin, Texas, which helps us understand the local market and business environment. Sometimes business valuations require site visits and interviews. Again, our local presence is an asset.

We Comply with Revenue Ruling 59-60

While most of our competitors do not even mention the IRS and its Revenue Ruling 59-60, we are proud to say that every business valuation we perform is fully compliant.

There are some key points in this ruling that are very important to understand when valuing a business.

For example:

- Never use pre-determined formulas

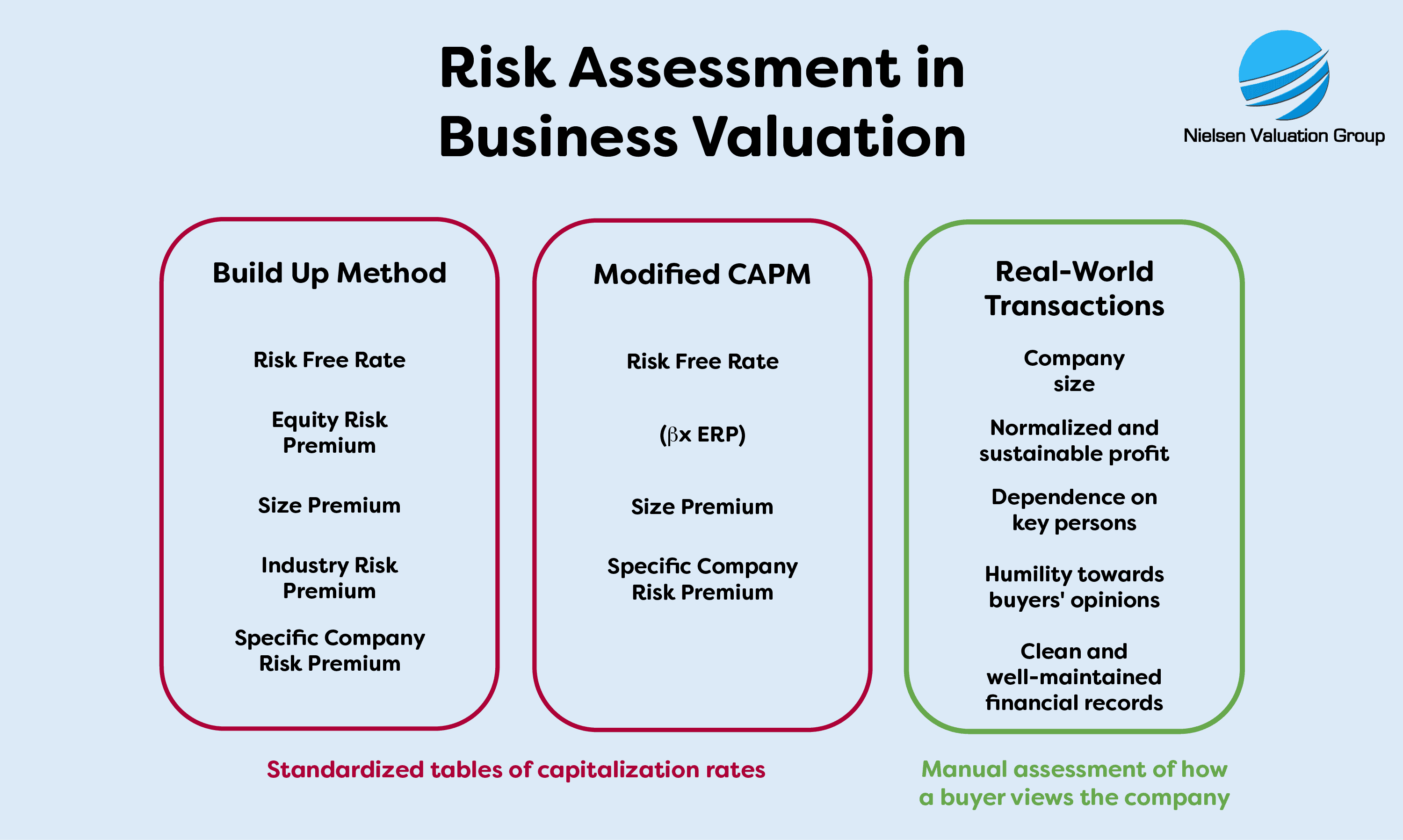

- Be careful with standardized tables of capitalization rates

- Consider the nature of the business, what risks are involved and the irregularity or stability of earnings

Here are parts of the ruling, more in detail, to illustrate how strongly the IRS emphasizes the need for manual valuations:

“Valuations cannot be made on the basis of a prescribed formula.”

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

While some Austin business appraisers might spend less time by taking such shortcuts, we make sure that we always comply with this ruling.

What this means in practice is that we fully investigate the current situation of the business. We do not simply plug numbers from the books into formulas. We examine the business, adjust the numbers, and apply customized calculations that are appropriate to the situation.

Normalization First

Much of the work involved in a well-researched business valuation is in the preparation. The income statements and balance sheet should never be taken at face value.

Why not? Because:

- The balance sheet shows book value, and that is often not the same as market value. We have to find out what the assets are really worth. Sometimes this applies also to liabilities.

- The income statements can include income or expenses that are one-time or not related to the core business. For example, the sale of assets. It can also include personal expenses of the owner(s).

These are just a few examples to illustrate why taking the numbers directly from the books leads to a flawed valuation.

That is why we make sure to fully normalize the company’s balance sheet and income statements before making any calculations or estimates. With clean data, we can then proceed to make a fair judgment of the company’s fair market value.

Our Choice of Valuation Approaches

We carefully select one or more valuation approaches for each Austin business valuation. We understand that each situation requires careful consideration in the choice of method and how it should be applied.

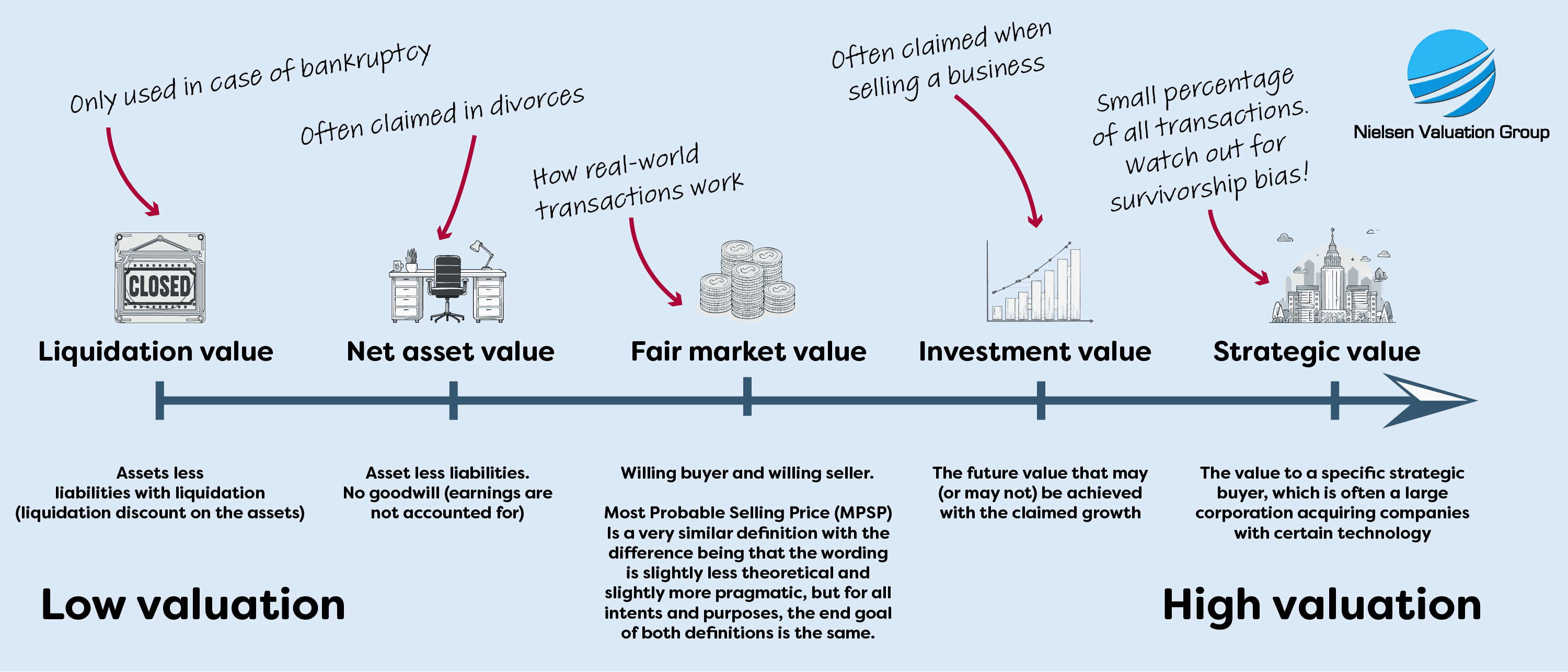

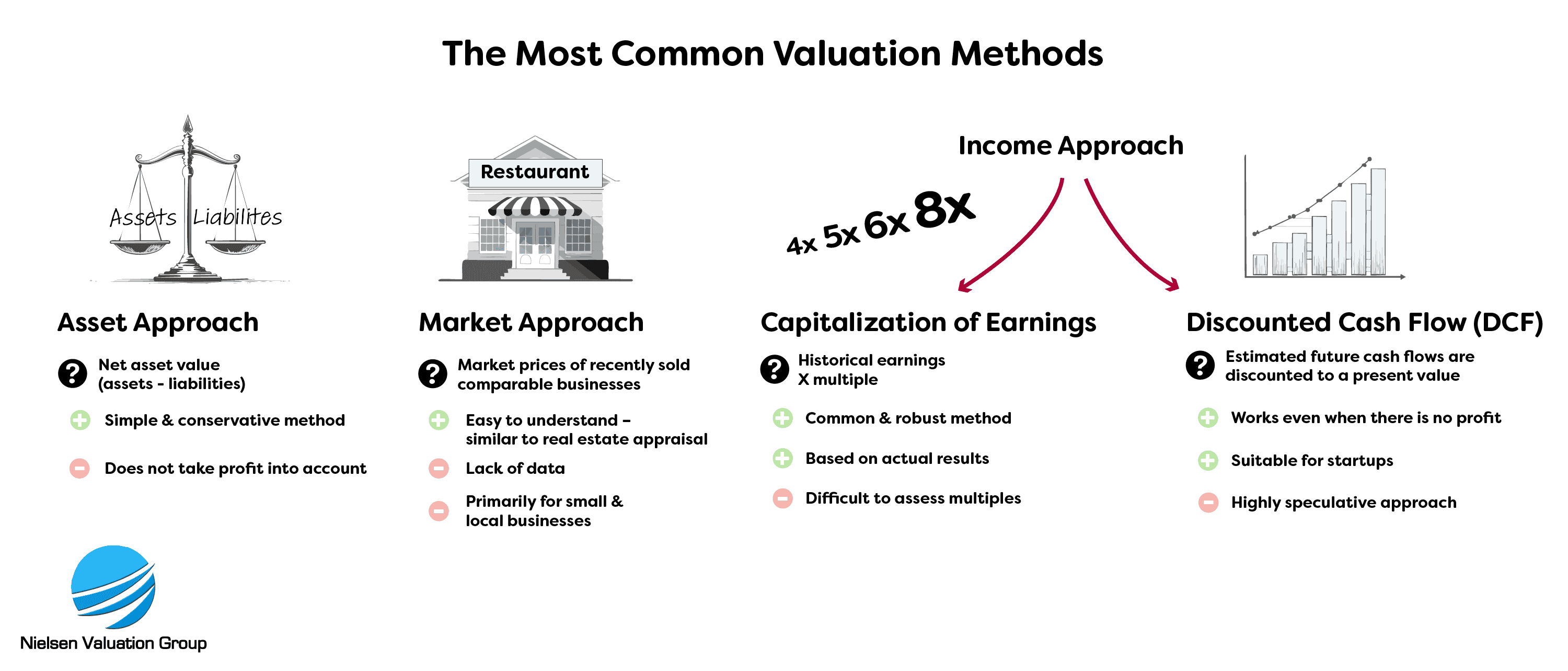

There are several approaches to valuation:

- Market approach: Based on what other businesses in Austin have sold for.

- Asset approach: A valuation based on the market price of assets minus liabilities.

- Income approach: Business valuations based on earnings and/or cash flow.

In most situations, we use a combination of the income and asset approaches to arrive at a credible business valuation.

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.” IRS RR 59-60

We never use pre-determined formulas or standardized tables of capitalization rates in our valuations.

When discount rates are required, we determine them based on our expertise from real-world market transactions, rather than relying on theoretical models.

100% Customized Business Valuation in Austin, TX

While some valuators apply a “one size fits all” approach to every business, we ensure that the approaches used are appropriate and tailored to the business in question – as well as the purpose for which the valuation is being performed.

This can have a significant impact on how your valuation is perceived and accepted by other parties, for example in business negotiations or in court.

When you reach out to Nielsen Valuation Group, we begin with a free 30-minute consultation where you can provide us with some initial information about your business and the purpose of the valuation. This will help us provide you with a tailored proposal.

We know that far too many people overpay for aspects of their business valuation that they don’t need. With us, you only pay for what you need.

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“ IRS RR 59-60

What is the Value of My Austin Business?

Are you thinking of selling a business in Austin?

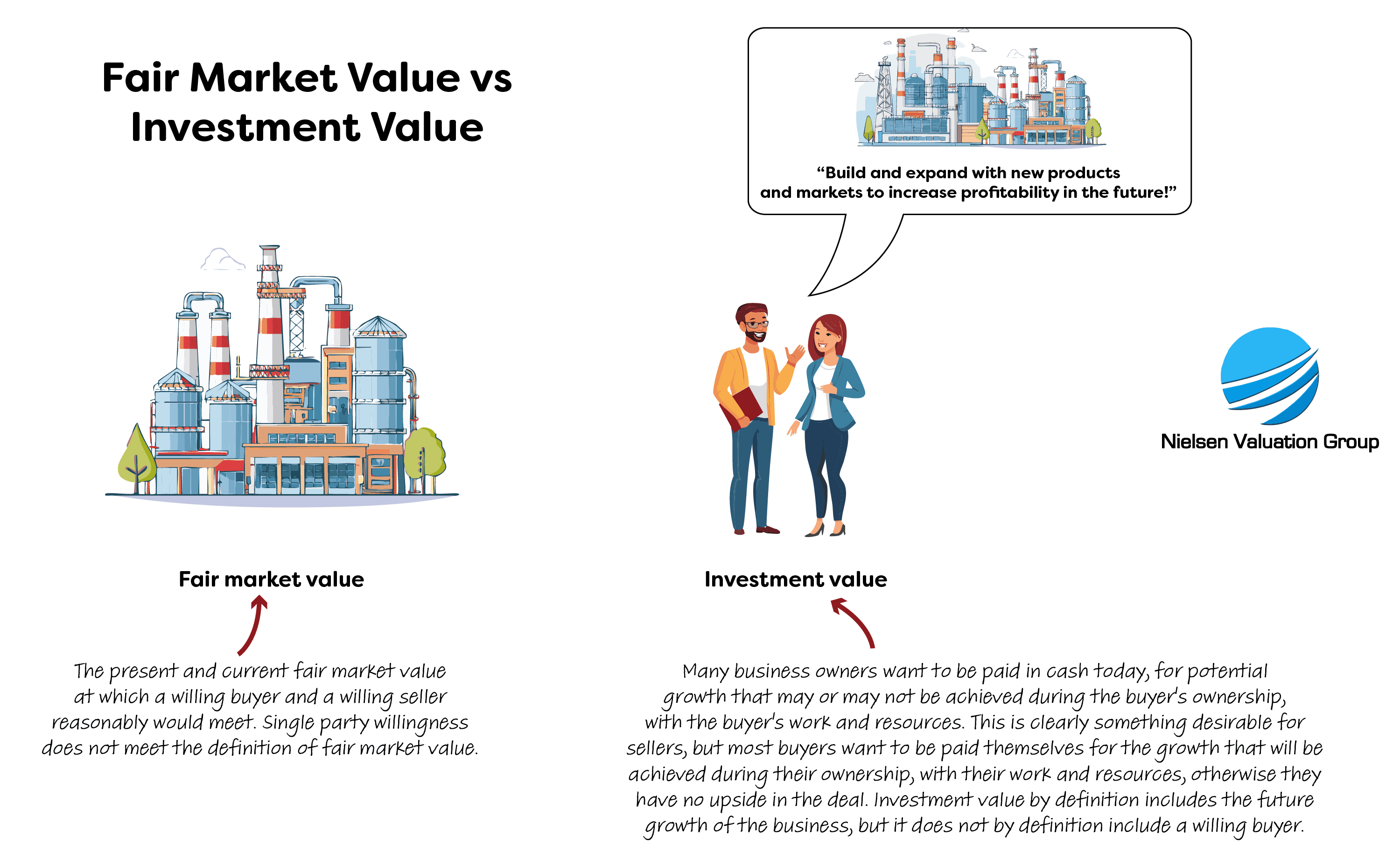

Its actual value depends on what someone is willing to pay for it. Theoretical values based on hypothetical assumptions may lead to high valuations, but they are of little use when it comes to selling your business.

That is why we focus on determining fair market value – not a fantasy valuation.

We would also like to share a few other insights:

Sellers generally want to be paid for the future potential of the business. A buyer, on the other hand, will only want to pay for the track record and current state of the business. Any potential is the upside of the investment and can be seen as compensation for the risk the buyer is taking. By understanding this, you as the seller can arrive at a price at which you can find a buyer in the market.

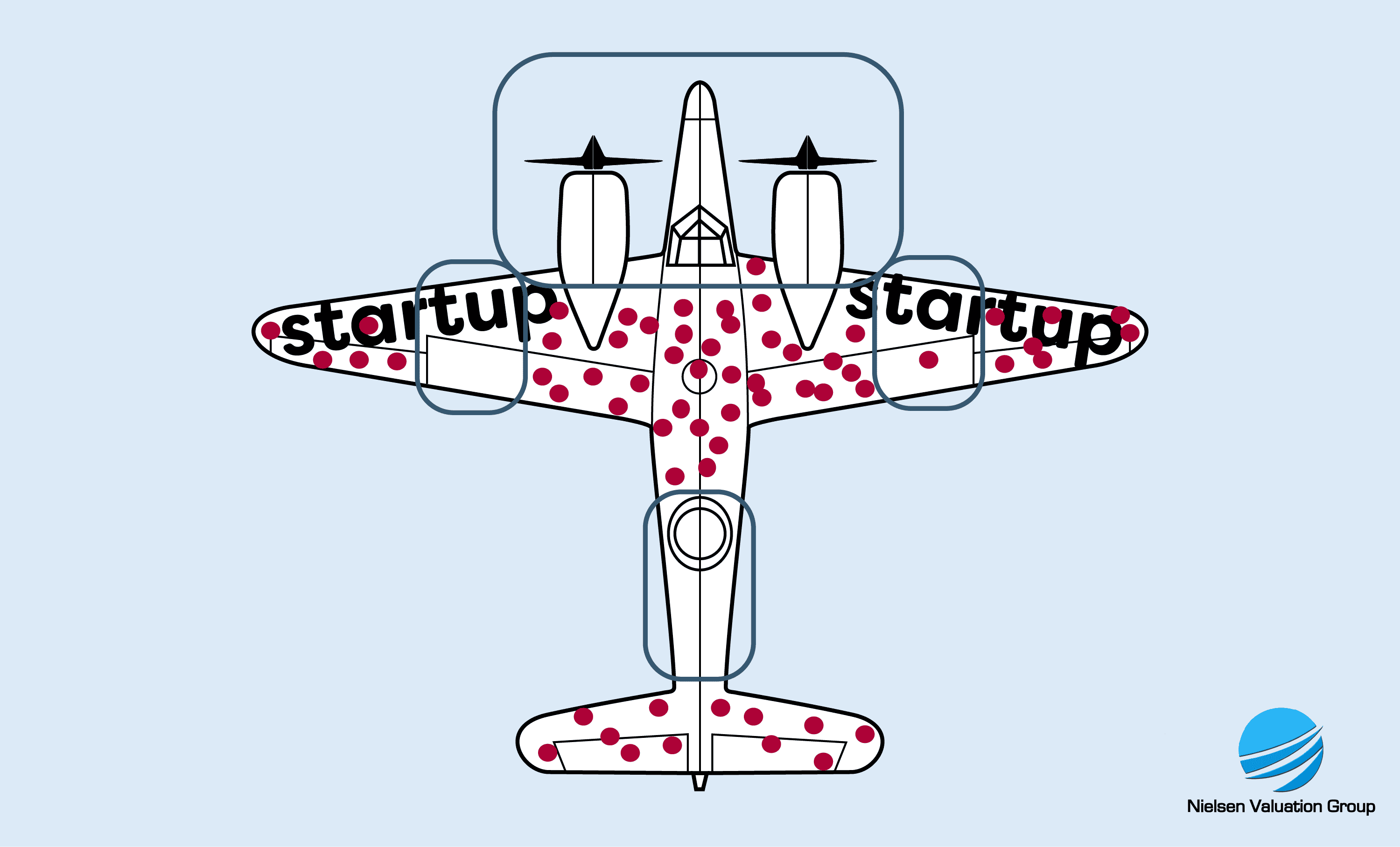

A second insight regards survivorship bias. This is especially common among startups that point to successful cases like Alphabet, Meta, Uber, or Tesla. They argue that their company will follow a similar path.

However, investors and buyers know that only about one in ten startups survive in the long run, which is reflected in the price they are willing to pay.

These insights tell us: Price your business realistically if you want to sell it. We can help you determine the right price.

The image illustrates the origin of the term survivorship bias, which many startups suffer from. During World War II, there were studies of fighter planes returning to base. The analysts believed that the planes did not need reinforced armor for the cockpit, around the engines, and part of the wings because there was no damage there. The reality was that planes hit in those areas never made it back to base.

Are You Looking to Value an Austin Business?

Nielsen Valuation Group delivers unbiased, IRS RR 59-60 compliant business valuations in Austin, grounded in real-world transactions. Contact us today for a free 30-minute meeting.

FAQ – Frequently Asked Questions

How much does a business valuation cost?

The price depends on the complexity and size of the business being valued, as well as the purpose of the valuation. Contact us for a free 30-minute consultation and quote.

Do you value any type of business?

Yes, we do all types of Austin business valuations, but we refrain from valuing pure startups.

How quickly can the report be completed?

In most cases, our valuation will be delivered to you within 5 to 15 days. If you are in a hurry, please let us know and we may be able to accommodate your request.

Can you help increase my Austin business valuation?

While we always deliver business valuations with high integrity, reflecting the company’s fair market value, we can help you gain insight into what you can do to increase your Austin business valuation.

This is useful as part of exit planning or prior to selling your business. There are often several things to do, including “low hanging fruit”. Contact us today and we can help.

Is the valuation report admissible in court?

Yes. When ordering, please specify that the report is intended for court use. We have provided business valuations that have helped numerous clients in legal proceedings. If needed, we can also present our findings in court.

Do you make site visits?

Yes, if the situation requires it or if requested, we will conduct site visits. We can also talk with key staff.

What kind of business valuation services can you help me with?

We can help you with your business appraisal in many situations:

- Buy a business

- Sell a business

- Divorce settlements

- Litigation

- Tax planning

- Estate planning

- Insurance matters

- ESOP

- Business restructuring or liquidation

- Buy-sell agreements

- Partner buyouts

- Partner or shareholder disputes

- Business loans or funding

- Investments, mergers and acquisitions

- And more!

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence