Your Unbiased Business Valuation in San Antonio

Revenue Ruling 59-60 compliant business valuations, crafted to reflect real-world transactions.

Unbiased Business Valuation in San Antonio

Nielsen Valuation Group provides business valuation services in San Antonio that are fully compliant with IRS 59-60 Revenue Ruling. Our appraisals are non-speculative and completely unbiased, designed to provide an accurate and reliable fair market value that reflects real world transactions. Contact us now for a 30-minute consultation.

- We always use the perspective of real-world buyers

- No predetermined formulas

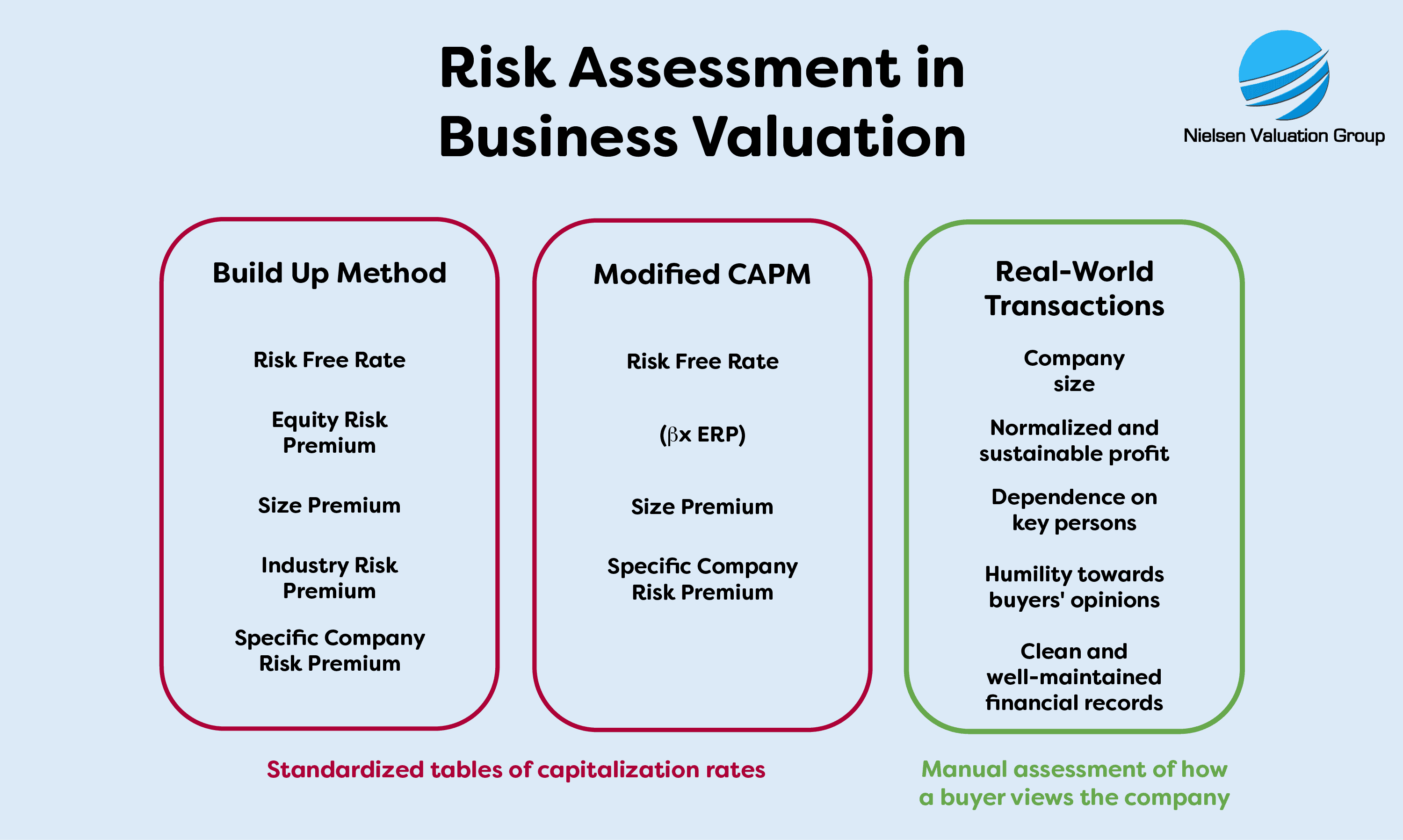

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

We Offer Fair Market Business Valuation in San Antonio

Nielsen Valuation Group provides fair market business valuations in San Antonio, Texas.

We pride ourselves on being fully compliant with Internal Revenue Service (IRS) Revenue Ruling 59-60.

In practice, this means that our appraisals represent a credible market value of the business based on real transactions – not theoretical frameworks and formulas.

“Define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. Court decisions frequently state in addition that the hypothetical buyer and seller are assumed to be able, as well as willing, to trade and to be well informed” IRS RR 59-60

We have a local presence in San Antonio, which is an asset when valuing a business here. Our knowledge of the local business community and market, as well as our ability to conduct site visits when necessary, is an added benefit to you.

Business Appraisals that Comply with IRS RR 59-60

We take it for granted, but many San Antonio business valuation firms pay little or no attention to IRS Revenue Ruling 59-60.

There are several reasons why this ruling is important to us. One key reason is that it highlights the need for fact-based business valuations. For example, the ruling states that:

- Pre-determined formulas should not be used.

- Standardized cap rate tables oversimplify the reality in the business.

- The earning capacity, risks involved and the nature of the business are important factors to consider.

Here are some examples of what the RR 59-60 says:

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

“Valuations cannot be made on the basis of a prescribed formula.”

We believe the reason so many appraisers do not follow these principles is because it takes time and hard work to value a business without handy formulas, tables and cheat sheets.

When we value your business, we make sure to uncover the facts behind the numbers and deliver a valuation that is fully IRS compliant.

We Begin by Normalizing the Books

A well-executed business valuation requires thorough preparation. The inputs must be correct for the output to be trustworthy.

For valuations, this means normalizing the balance sheet and income statements. Only thereafter the calculations can be done.

Here is why:

- The balance sheet shows the book value of assets and liabilities. Book value is not the same as market value. There may also be assets and liabilities that are not visible on the balance sheet.

- The income statements can include income and expenses that are not representative of the business. They may be in the form of one-time payments or expenses. For example, should the sale of an asset like the company’s cars really contribute to a higher valuation?

Normalizing the books is a prerequisite for a fair market valuation. At Nielsen Valuation Group, we go to great lengths to get it right.

Robust Methodologies – Not Formulas

Every business valuation we perform follows one or more valuation approaches, but we do not use pre-determined formulas.

Such formulas do not take into account the underlying conditions in the company. They are always an oversimplification and, because of the complexity of the calculations, can lead to a false sense of security that the valuation is accurate.

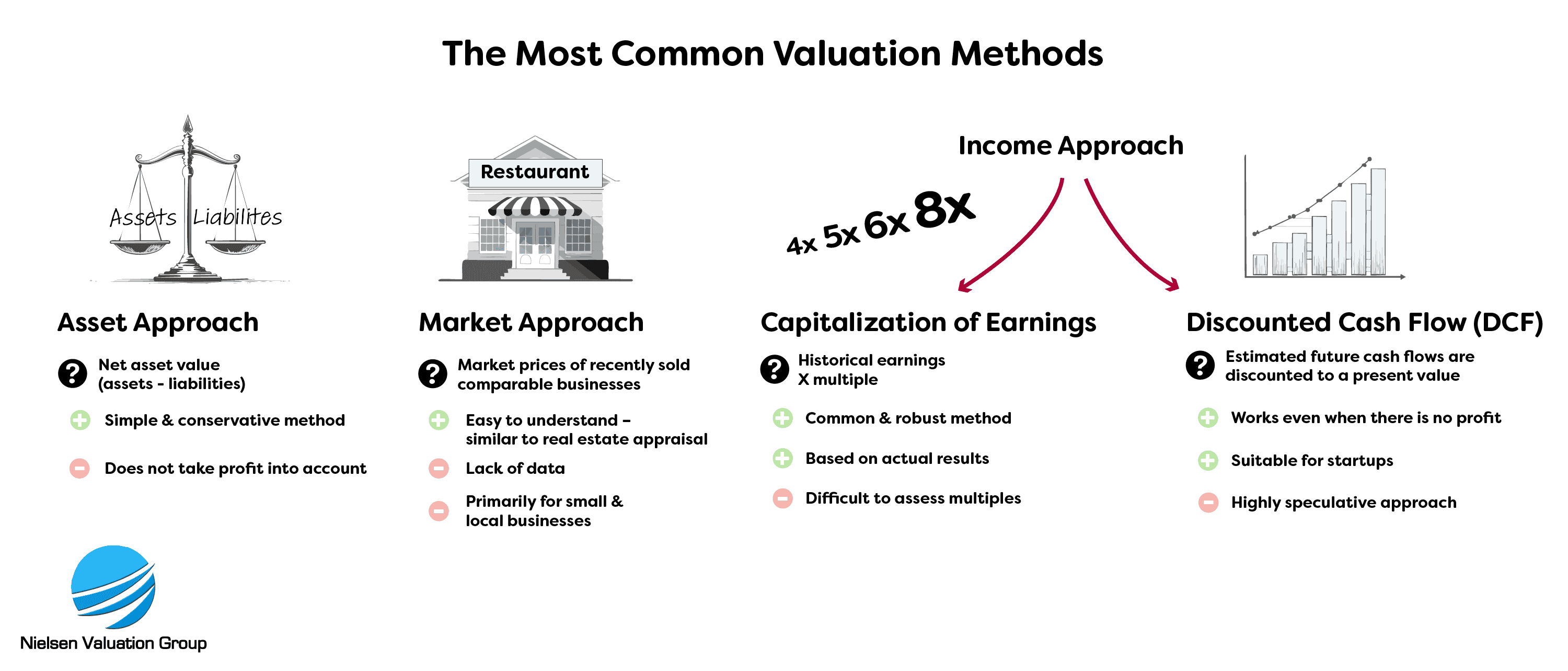

Instead, we use one or more valuation approaches that are appropriate to the situation:

- Income approach: Takes cash flow or earnings into account.

- Asset approach: Based on the net value of assets after deducting liabilities.

- Market approach: Looks at what other San Antonio businesses have sold for.

Once we select one or more approaches, we apply robust calculations that we tailor to the situation and the purpose of the valuation. The result is a non-speculative, fact-based appraisal.

When marketability discount rates are needed, we calculate them. We never derive them from theoretical studies.

Tailored San Antonio Appraisals

Every business valuation we perform is fully tailored – both to the business being valued and to the purpose of the appraisal.

Different types of businesses require different approaches, and the purpose of the valuation will dictate the level of detail, focus and disposition of the report.

For this reason, we always offer a free 30-minute, no-obligation consultation. Our meeting allows you to present the business in question and tell us the purpose of the valuation.

With this information, we can then provide you with a customized quote. We believe that you should never overpay for a business appraisal by getting services that you do not need.

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“ IRS RR 59-60

How Much Is My San Antonio Business Worth?

If you are looking to sell a business in San Antonio, we can provide you with a well-balanced business valuation that will increase your chances of getting it sold.

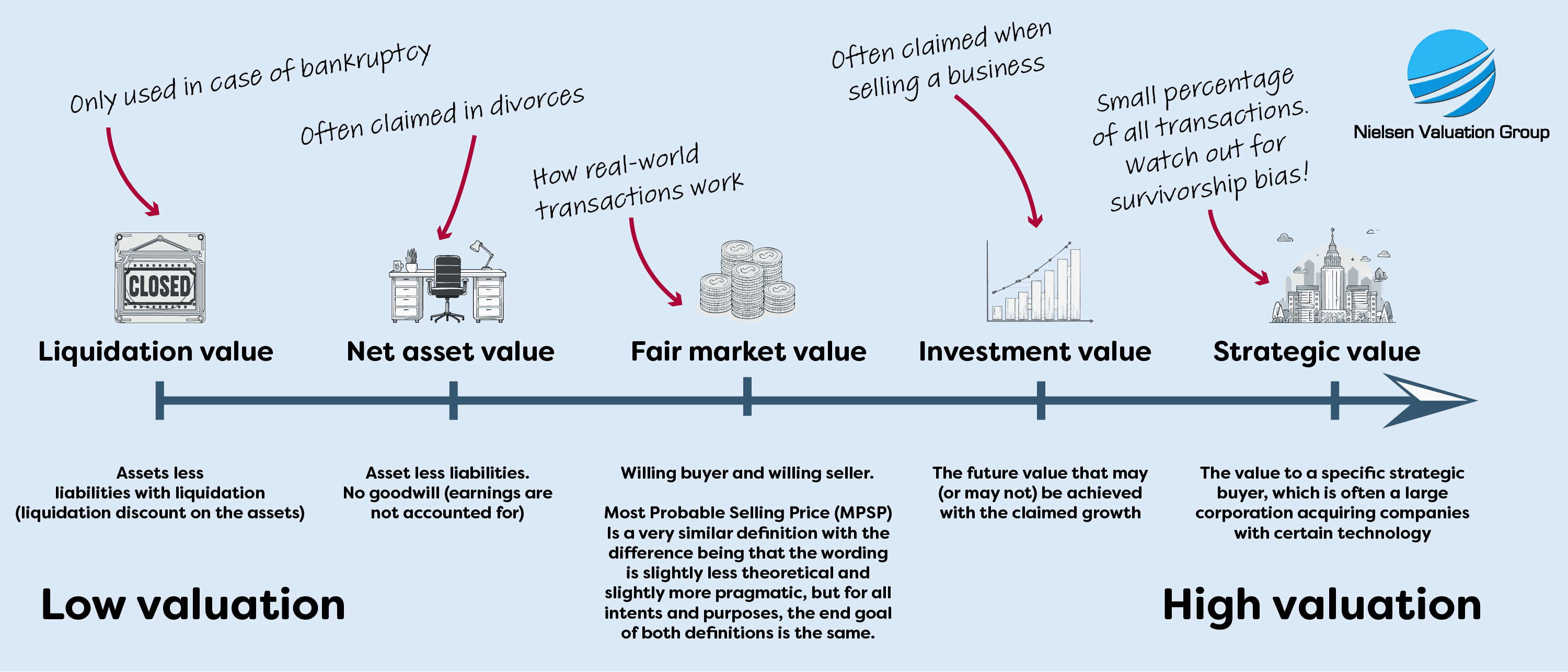

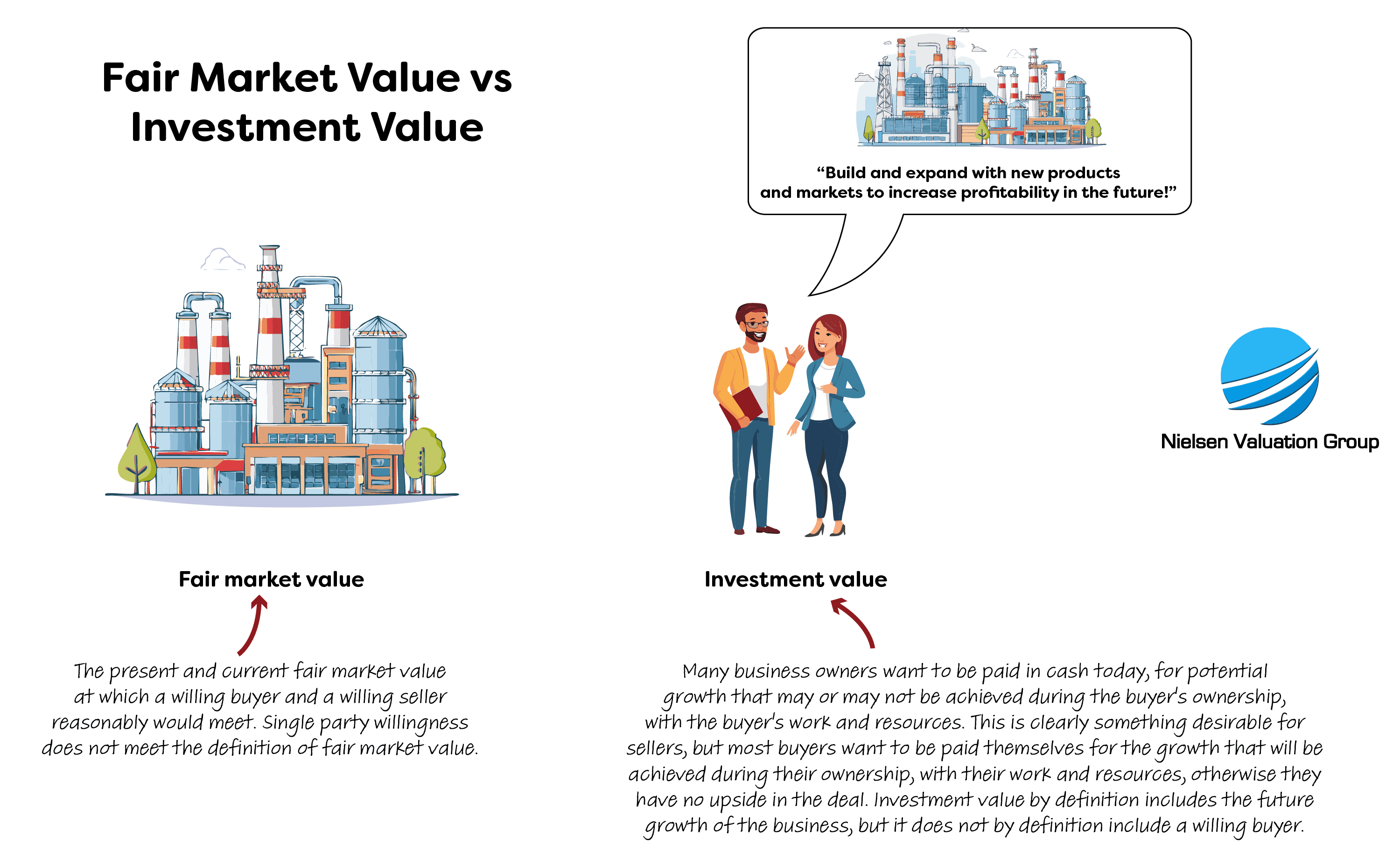

How much a business is worth is actually what someone is willing to pay. Our appraisals strive to arrive at a number that is as close as possible to what is called fair market value.

When we talk to sellers, we often hear that they want the business valued with its future potential in mind. But we know from experience that buyers are never willing to pay for potential unless they can also pay with potential, such as shares in another risky business. Buyers pay for the business with regard to its current state and with its track record in mind.

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.” IRS RR 59-60

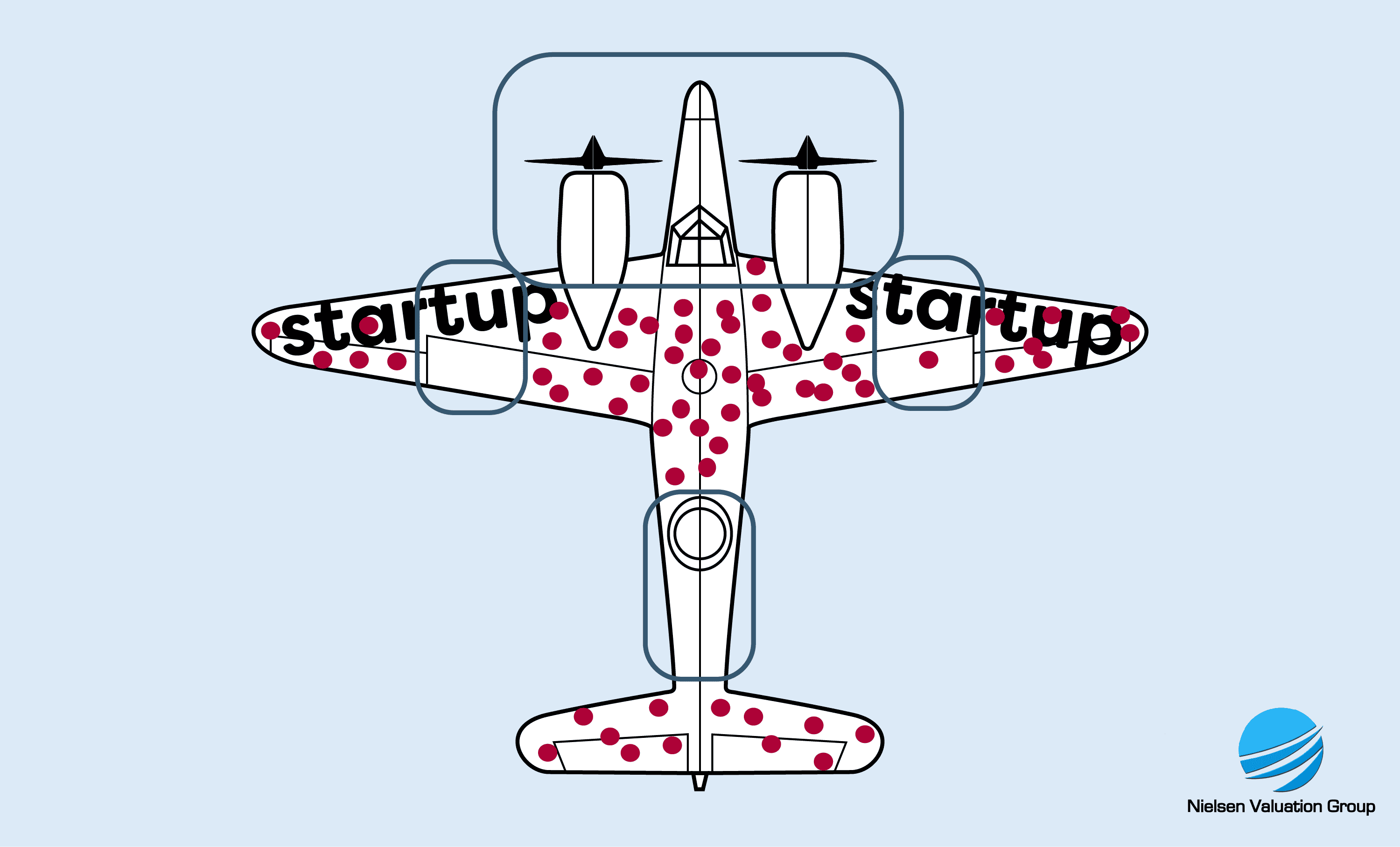

Sellers of startups often face another problem: they often suffer from survivorship bias. They look at successful startups like Tesla, Uber, Alphabet or Meta and say that their business is likely to follow a similar trajectory.

Investors, on the other hand, know that only about 1 in 10 startups survive in the long run, and therefore they price this into their offer when buying or investing in a startup.

By being aware of these facts as a seller, you can increase the likelihood of finding a suitable buyer.

What does survivorship bias mean? The term comes from World War II, when analysts studied the damage to planes returning to base to figure out where to reinforce armor. Since the cockpits, engines, and parts of the wings were never hit, it led to the erroneous conclusion that these parts did not need to be reinforced. The reality was that planes that were hit there had crashed.

Do You Want to Do a Business Valuation in San Antonio?

We offer Revenue Ruling 59-60 compliant and fully unbiased business valuations in San Antonio, that reflect real-world transactions. Contact us now for a free 30-minute consultation.

FAQ – Frequently Asked Questions

How much does it cost to get a business valuation in San Antonio?

The price depends on the type of business you are valuing, its complexity, and the reason for the valuation. Contact us for a custom quote.

Do you do all types of business valuations?

Yes, we do all types of business valuations except start-ups.

How quickly can the valuation report be completed?

We deliver your valuation report within 5 to 15 days. We will let you know the estimated delivery time in the quote. Please let us know if you need a valuation urgently. We may be able to deliver it sooner.

Are your appraisals admissible in court?

Yes, they are. We have a track record of providing unbiased business valuations that have been successfully used in court. Please let us know during our consultation if you will be using the valuation for litigation or other legal matters, and we will make sure it is tailored to your needs.

Will you visit the business in question in San Antonio?

Yes, if necessary or requested. We have a local presence in San Antonio and would be happy to conduct a site visit and interview key personnel if necessary.

What kinds of business valuation services do you offer?

We are happy to assist you with business valuations in a variety of situations:

- Buy a business

- Sell a business

- Liquidation or restructuring

- Buy-sell agreement

- Partner buyout

- Shareholder or partner dispute

- M&A, strategic planning & investments

- Divorce valuation

- Insurance

- Estate planning

- And more!

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence