Your Unbiased Business Valuation in California

Business valuations that comply with Revenue Ruling 59-60 and are designed to reflect real-world transactions

Unbiased Business Valuation in California

Nielsen Valuation Group provides an non-speculative and unbiased business valuation in California that reflect the dynamics of real-world transactions. We fully comply with IRS Revenue Ruling 59-60. We carefully examine the situation of the business, always with the goal of determining fair market value. Unlike many appraisers, we never use pre-determined formulas or other shortcuts. Call us today for a free 30-minute consultation with one of our advisors.

- We always use the perspective of real-world buyers

- No predetermined formulas

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

We Cover the Following Areas of California

We provide our business valuation services throughout the state of California, and one of our consultants can also conduct on-site visits and interviews if needed.

We serve the following locations:

Northern California

- San Jose

- San Francisco

- Sacramento

- Oakland

- Stockton

- Fremont

- Santa Clara

- Modesto

- Carmel

- Fresno

- And more!

Southern California

- Los Angeles

- San Diego

- Long Beach

- Anaheim

- Santa Ana

- Riverside

- Chula Vista

- Irvine

- San Bernardino

- Bakersfield

- And more!

Looking for a Business Valuation Company in California? Here is Why We Stand Out

At Nielsen Valuation Group, we believe that business valuations should reflect how real-world transactions work. What a business is really worth is what someone is willing to pay for it. That is why we always strive to determine fair market value.

In doing so, we stay away from speculation or pre-defined formulas that create a “value on paper”. Instead, we look at what is actually happening in the business – its track record, current situation, risks and prospects.

In doing so, we fully comply with Internal Revenue Service (IRS) Revenue Ruling 59-60.

The following sections describe in more detail how we conduct our valuations in California.

IRS Revenue Ruling 59-60 & Fair Market Value

If you ask ten business appraisers in California to value a business, you will probably get ten different valuations. Many will stick to their formulas or systems, but surprisingly few will even consider the principles outlined in IRS Revenue Ruling 59-60.

For us and our valuations, this ruling is important. Not only is it an authoritative source that every business owner and appraiser should be aware of. It is also important because it demonstrates the need to consider the dynamics of real world transactions when assessing the value of a business.

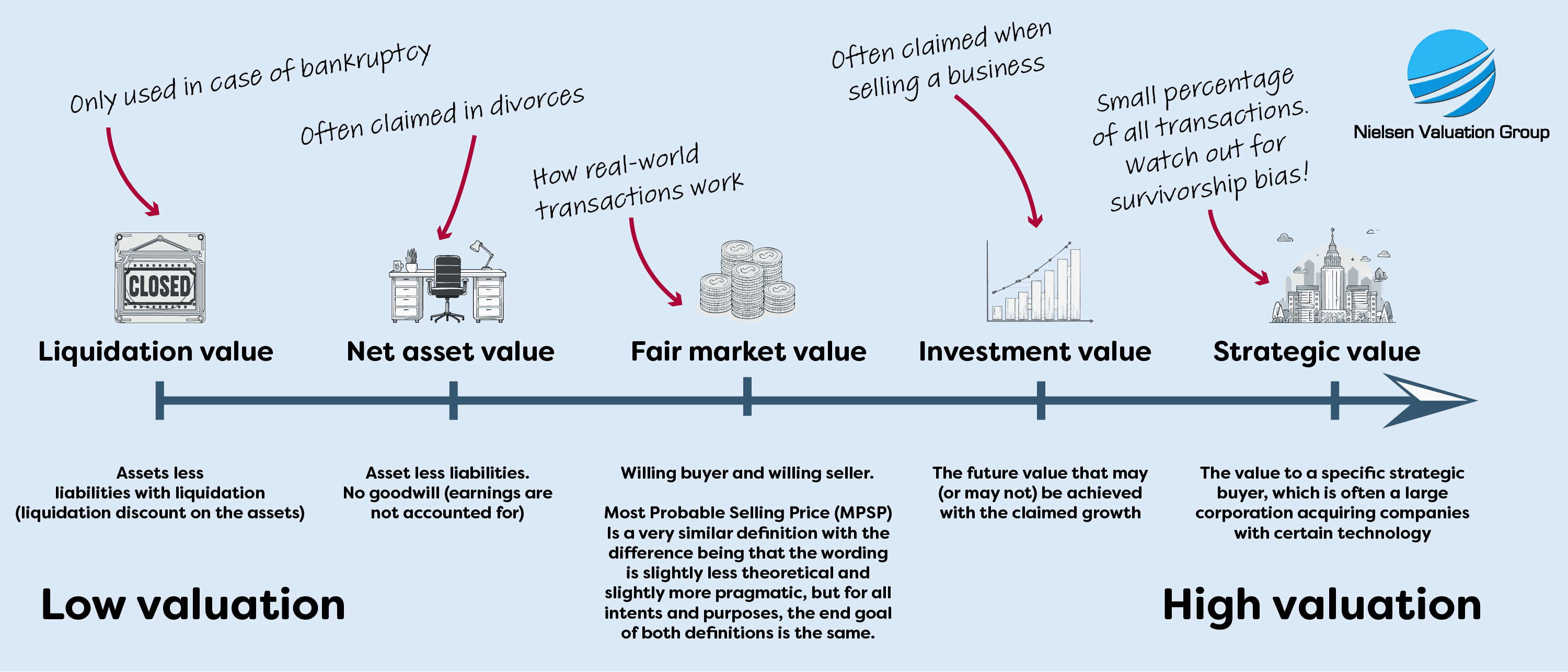

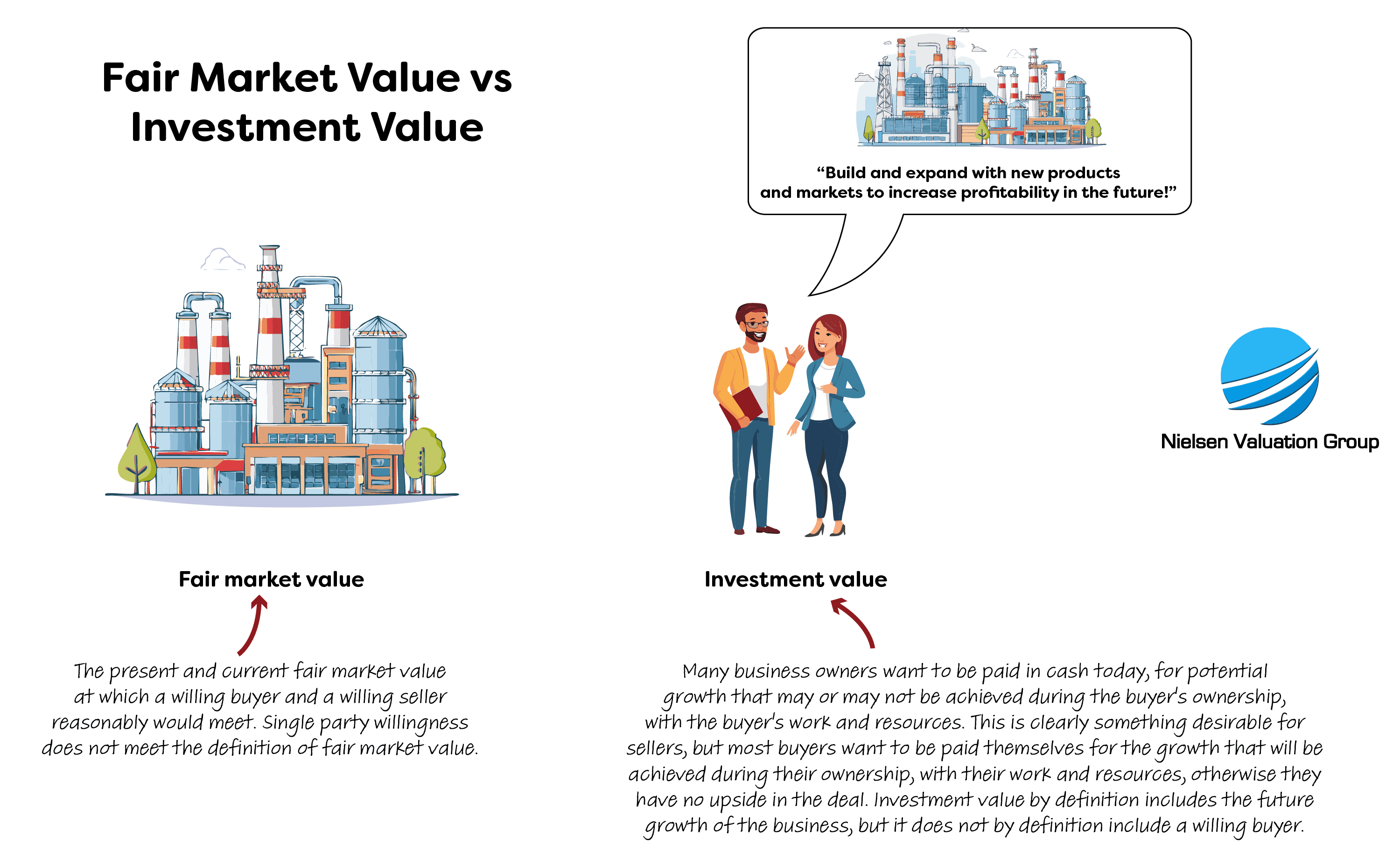

It mentions the need to determine fair market value. This is the price that a potential buyer and seller would be willing to agree on voluntarily in a free and open market.

The ruling draws some specific conclusions about how a business valuation should be conducted. For example:

- Never use predetermined formulas.

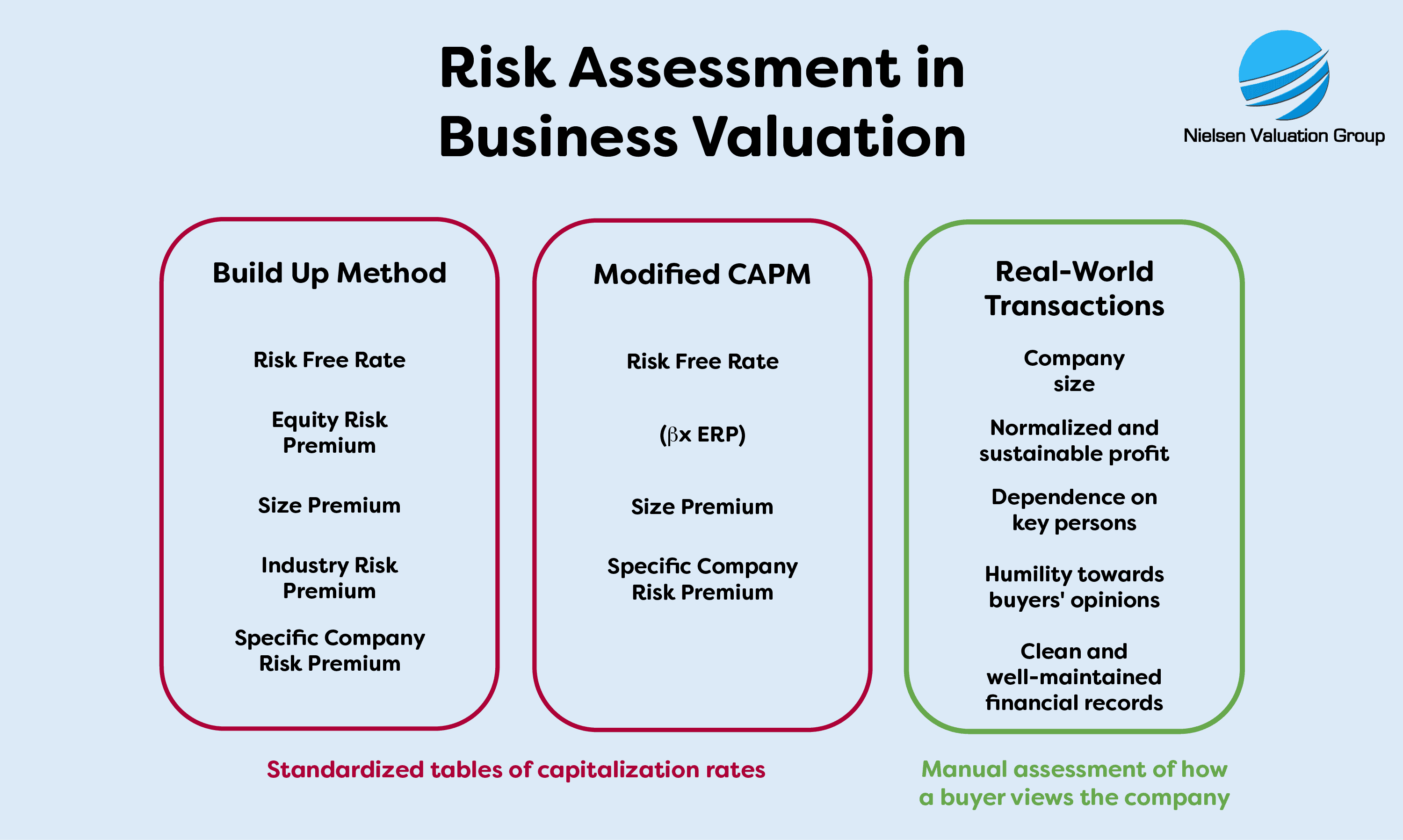

- If you use standardized tables of capitalization rates, the valuation may be misleading.

- Mathematical weights are not useful in weighing various factors. Instead, the actual situation in the business must be reviewed.

- You need to take into account the actual risks in and the nature of the business, as well as the stability or irregularity of earnings. Never make standardized assumptions.

We can illustrate this with a few quotes from the ruling:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.”

When we perform a business appraisal in California, we fully respect this ruling. What this means for you as a client is that you will receive a balanced, unbiased, and robust valuation that will stand up to scrutiny and will likely help you gain the respect of your counterparts.

Our Process Begins with Normalizing the Financial Statements

One of the most important aspects of a business valuation is not the calculation, but the preparations. We begin each valuation by normalizing the financial statements.

This consists of two parts:

- The balance sheet: It shows the book value, which is not necessarily the same as the current market value. To get the right inputs for the valuation, our job is to make sure that all significant assets are valued at market value. Adjustments may also be needed for liabilities.

- The income statements: These typically include expenses or income that are not representative of the business, one-time income or expenses, personal expenses, and the like. All such irregularities must be adjusted.

By normalizing the balance sheet and the income statements we start our valuation with correct numbers, which is a prerequisite for an accurate appraisal.

Selecting the Right Valuation Approach

Your business valuation requires one or more approaches. This is not to be confused with the use of pre-defined formulas, a practice we do not use. We want to underline that each business requires a tailored approach, designed by an expert.

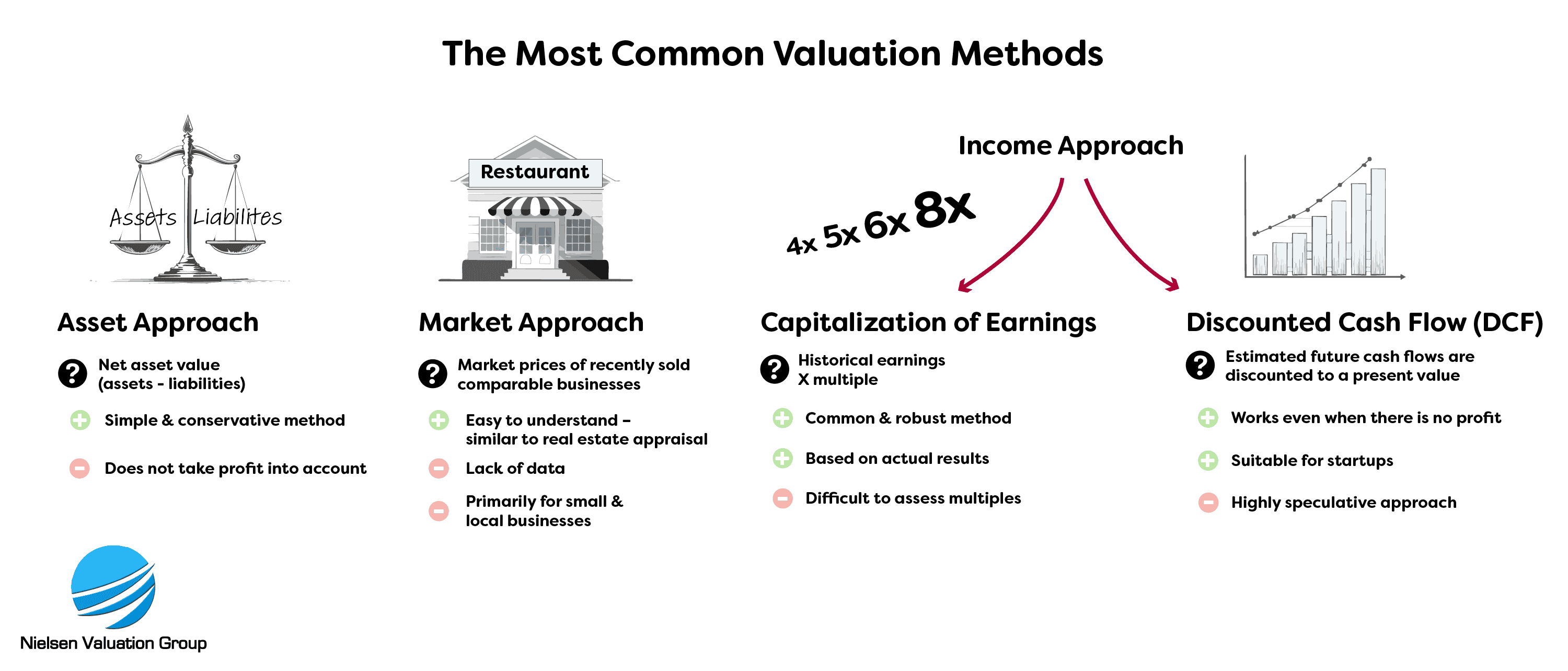

There are three main approaches that can be used:

- Market approach: What are other similar businesses selling for in California?

- Asset approach: Based on the net asset value at market prices in the business.

- Income approach: An estimate of value based on cash flow or earnings.

At Nielsen Valuation Group, we typically use the income approach in combination with the asset approach to provide a nuanced fair market valuation of the business.

A discount rate may need to be applied if, for example, the business is distressed or facing liquidation. In such cases, we make all calculations based on the actual situation, guided by how real-world transactions work. Not just theoretical frameworks.

Your California Business Valuation, Tailored Precisely to You

Every customer’s needs are unique. So is every business. Some business valuation companies in California tend to believe that a one-size-fits-all approach can be applied. We firmly believe that the only right approach is to tailor our services to your needs.

We need to consider the type of business, its size and complexity, the industry and the situation in the company. We also need to know the purpose of the valuation assignment in order to provide an assessment that meets your needs.

Therefore, we would like to offer you a free 30-minute consultation with one of our advisors before providing you with a customized quote. This will allow us to learn more about your needs and the business in question.

Finally, we firmly believe that you as a customer should never have to pay for services that you do not need. This is another reason why we prefer to offer 100% customized appraisals.

Discover the True Value of Your California Business

Thinking about selling your California business? Then you have probably wondered what a fair price would be.

Frankly, the value of any business is what someone is willing to pay for it.

However, it is not uncommon for business appraisers to provide valuations that are far from what a buyer or investor believes is a fair price. This is often due to the wrong choice of methodology, the use of prescribed formulas, heavy assumptions and speculation.

Instead, to arrive at an estimate that is closer to a credible market price, you need to find out what the fair market value is. This is exactly what we do when we perform a business valuation.

We meet with both buyers and sellers frequently, and we know how the market works and what issues come up in negotiations.

There are two common misconceptions among sellers:

1. “I Want to Get Paid for Untapped Potential”

Most sellers have a deep connection to their business. They “know” there is a lot of potential in it, only if you do X, Y, or Z. For example, add more capital.

But buyers never pay for potential. They pay fair market value based on the proven track record and the current state of the business.

Of course there is potential, but the buyer or investor sees that potential as the upside of the investment. The reward for the risk they are taking and the time and energy they are putting into the business.

2. “It’ll Be the Next Spotify — So It’s Worth More”

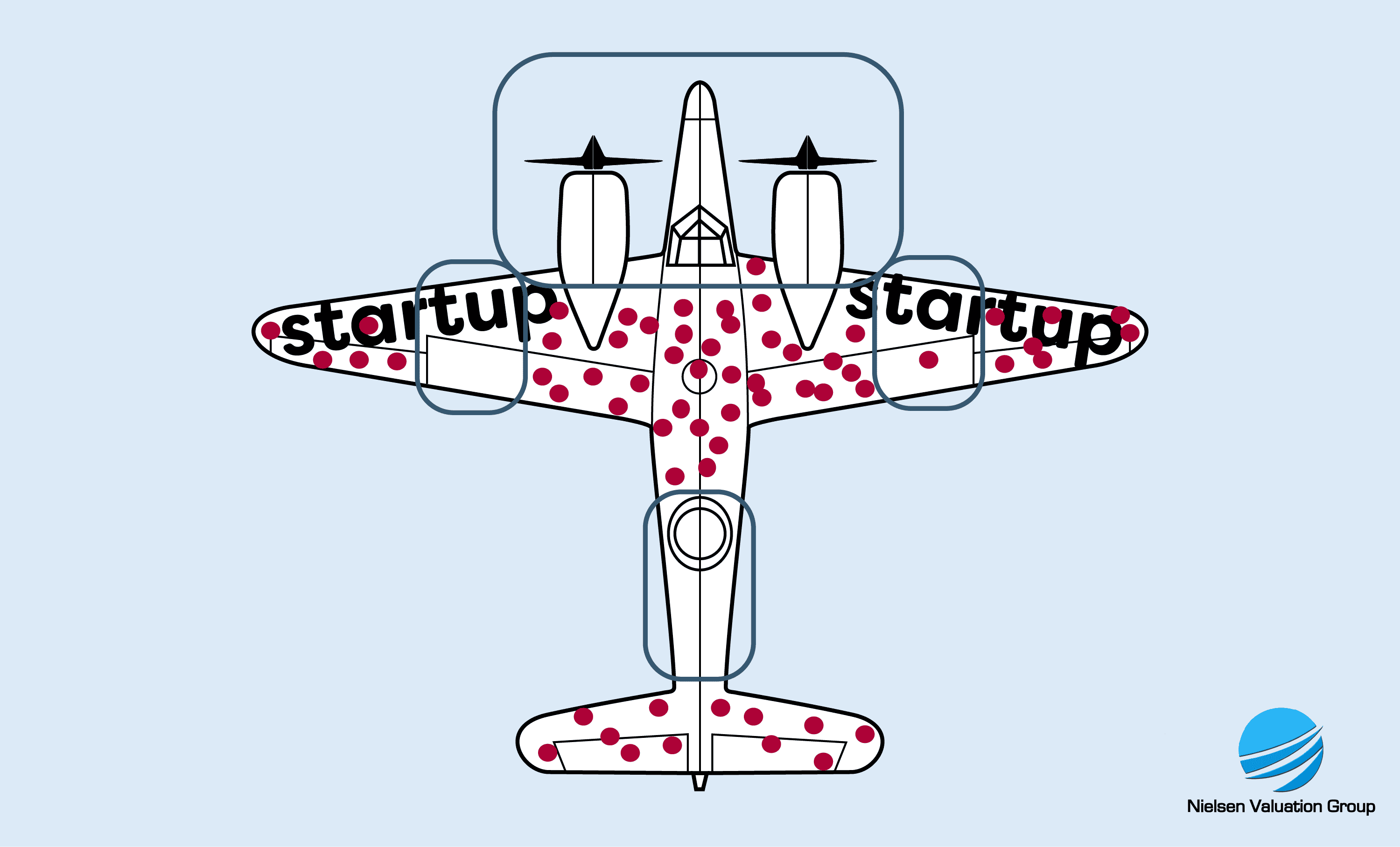

The second misconception is based on what we can call survivorship bias. Sellers of businesses, especially startups, often point to startup success stories as examples of where their business is headed.

The founder of a music streaming service might use Spotify as an example. Or the owner of an IT startup might point to the success of Meta or Alphabet.

The fallacy of drawing such parallels is that these companies are survivors. For every survivor, there are about nine companies that never made it.

Investors and buyers know this. They take big risks when they invest, and they need to mitigate those risks to protect their capital. Although they buy with the intention that the business will succeed, they know that the numbers are against them, which they factor into the price they are willing to pay.

Understanding how buyers think will help you set the right price expectations, which will improve your chances of selling your business.

Survivorship bias: The term comes from how World War II analysts incorrectly concluded that aircraft did not need armor reinforcements around the engines and cockpit, based on studies of those aircraft that returned from combat. Since there was little or no damage to these areas, they were considered safe. The truth was that planes were actually hit there, and when they were, they never returned to be part of the analysis. The same mistake is often made by entrepreneurs who use successful start-ups as a benchmark.

Let Us Help You with Your Business Valuation

Nielsen Valuation Group delivers unbiased, IRS RR 59-60 compliant business valuations in California, grounded in real-world transactions. Contact us today for a free 30-minute meeting.

FAQ – Frequently Asked Questions

How quickly can I receive your appraisal?

It usually takes between 5 and 15 days for us to complete the appraisal. If you need a quicker turnaround, please let us know.

How much does it cost?

The price is dependent on the size and complexity of the company being valued, as well as how the report will be presented and in what context it will be used. For example, an in-depth valuation to be used in a transaction or in court will require more work than a simpler verbal valuation.

Can you value all types of businesses?

Yes, we can. We do all types of business valuations except for startup companies.

Will you do a site visit?

We can conduct site visits and/or interviews anywhere in California if needed or requested.

What business valuation services do you provide in California?

We perform business valuations in all situations except for startup businesses. Some of the situations in which you can use our services include:

- Buying a business

- Selling a business

- ESOP

- Partner buyout

- Buy-sell agreements

- Divorce

- Litigation

- Shareholder disputes

- Partner disputes

- Business restructuring or liquidation

- Tax planning and other tax matters

- Estate planning

- And more!

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence