Unbiased Business Valuations in Los Angeles

Business valuations that comply with Revenue Ruling 59-60 and are designed to reflect real-world transactions

Unbiased Business Valuations in Los Angeles

Nielsen Valuation Group provides unbiased and IRS Revenue Ruling 59-60 compliant business valuations in Los Angeles that reflect how real-world transactions work. We examine businesses to determine their fair market value, as opposed to applying speculative formulas, or taking other shortcuts. Contact us now for a free 30-minute consultation.

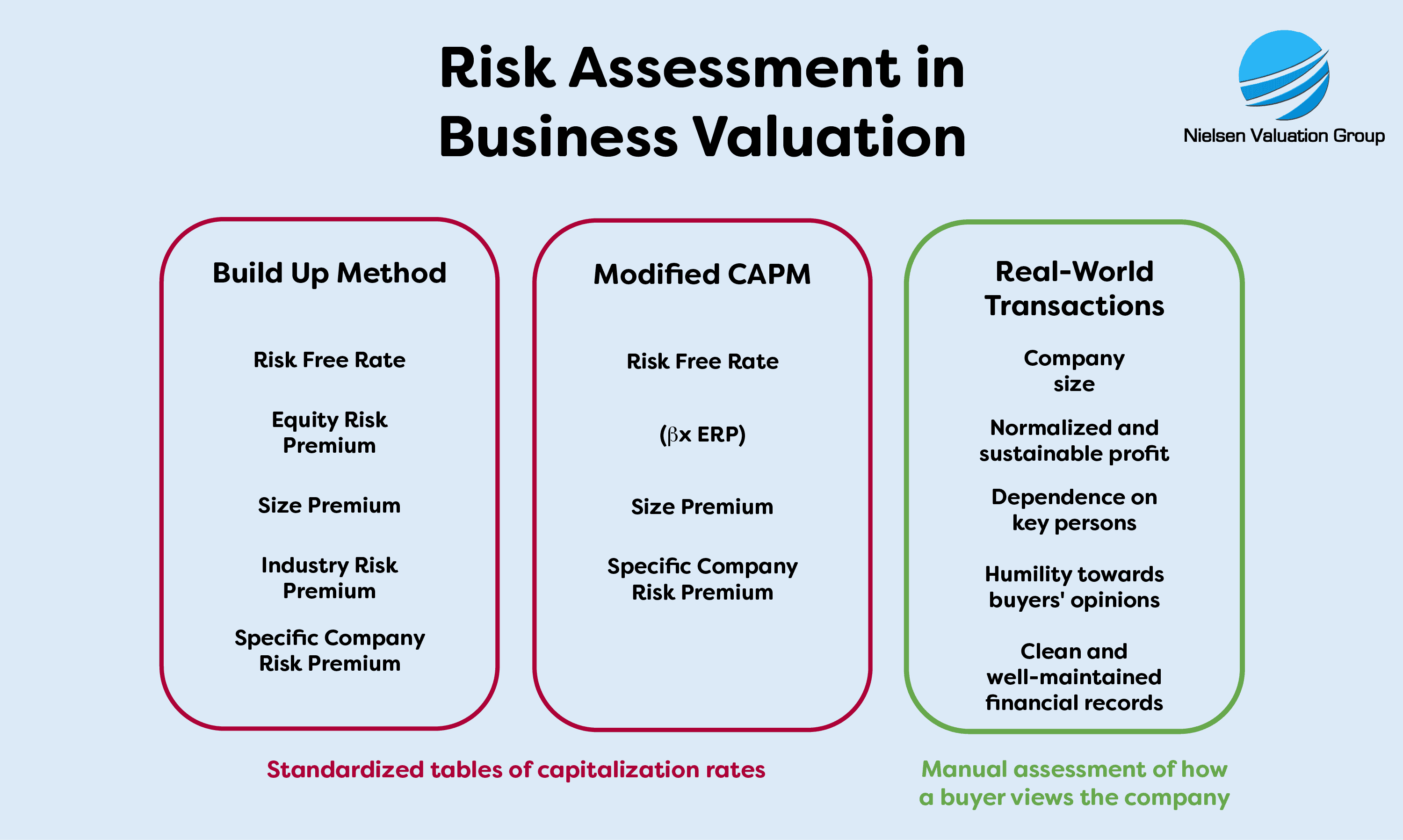

- We always use the perspective of real-world buyers

- No predetermined formulas

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

Four Good Reasons to Use Us for Your Los Angeles Business Valuation

There are plenty of business valuation companies in Los Angeles to choose from. Why choose Nielsen Valuation Group for your next business appraisal?

There are many good reasons, but we can boil them down to four main points:

- Full compliance with IRS Revenue Ruling 59-60: We strive to determine fair market value based on how real transactions work, free from predetermined formulas, vague long-term predictions or standardized approaches. Our work is completely manual.

- We normalize the financial statements: We ensure that all input data has been verified and adjusted to ensure a correct valuation.

- Balanced use of valuation approaches: There is no one-size-fits-all approach to business valuations. We choose our methods wisely and according to the situation.

- 100% customized valuations: Every client and every business is unique. We provide customized services to meet your needs and to help you avoid paying for services you do not need.

“Define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. Court decisions frequently state in addition that the hypothetical buyer and seller are assumed to be able, as well as willing, to trade and to be well informed” IRS RR 59-60

We strive at finding a credible market value, in contrast to finding a “value on paper”.

Below we will explain in more detail how this benefits you as a client.

Full Compliance with IRS Revenue Ruling 59-60

You would be surprised how few Los Angeles business valuation firms mention, much less follow, the principles of Internal Revenue Service (IRS) Revenue Ruling 59-60.

This ruling is important to us and we always follow it. First, it serves as an authoritative source of guidance on how a credible valuation should be performed. Second, it reflects how transactions actually work in the real world.

The ruling emphasizes the need to determine fair market value – the price that a prospective buyer and seller would be willing to agree to in a free and open market. To do so, it emphasizes that predefined formulas cannot be used:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

Nor can standardized tables of capitalization rates be used:

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

Instead, it is necessary to uncover what is really going on in the company. To study its track record, to understand its current situation, the risks, the stability or irregularity of its earnings, as well as its prospects.

Failure to do so will lead to an unreliable valuation, resulting in an overvaluation or undervaluation.

When you hire Nielsen Valuation Group for your business valuation in Los Angeles, we ensure that the entire process is performed manually, taking full account of the actual situation of the company.

We Normalize the Financial Statements

As a first step, any valuation requires careful normalization of the financial statements. We like to compare it to the prep work done in a paint shop before a car is painted. The prep work is necessary for the end result to be good and lasting.

In business valuations, this prep work consists of normalizing the income statements and the balance sheet:

- Income statements often contain irregularities that should not be included in the valuation. Some common examples include one-time income or expenses, such as the sale or purchase of an expensive asset, or the owner’s use of business funds for personal expenses.

- The balance sheet shows the book value of assets, which is rarely the current market value. This needs to be corrected before the valuation can be done. Sometimes the liabilities also need to be adjusted.

After we have normalized the income statements and the balance sheet we have clean data for our business appraisal.

Balanced Use of Valuation Approaches

Some Los Angeles business valuation companies seem to have a favorite approach that they use in every valuation. We understand that in order for a valuation to be correct, one must take into account the nature of the business in question, as well as the reason for which a valuation is being performed.

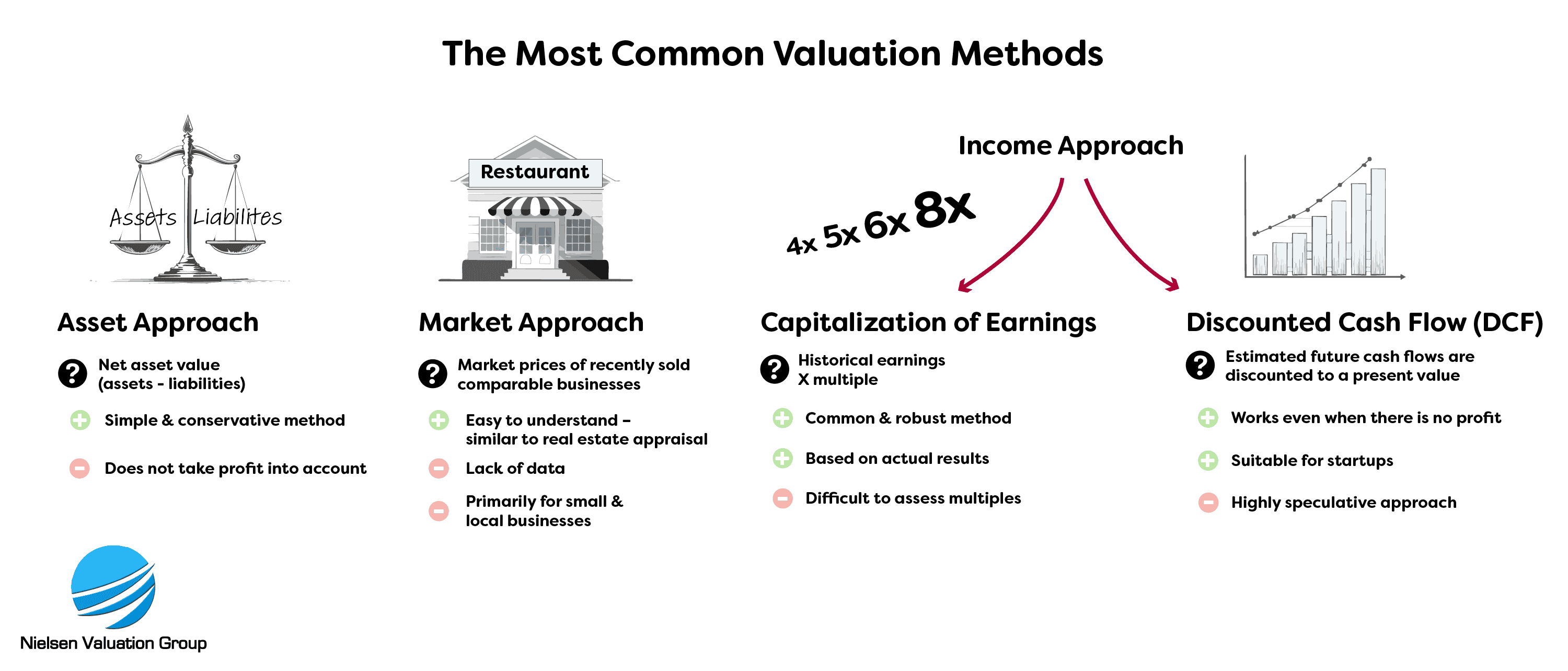

We have three main approaches:

- Market approach: This approach uses market data from past transactions of similar companies. It is an efficient approach as long as sufficient sales data is available.

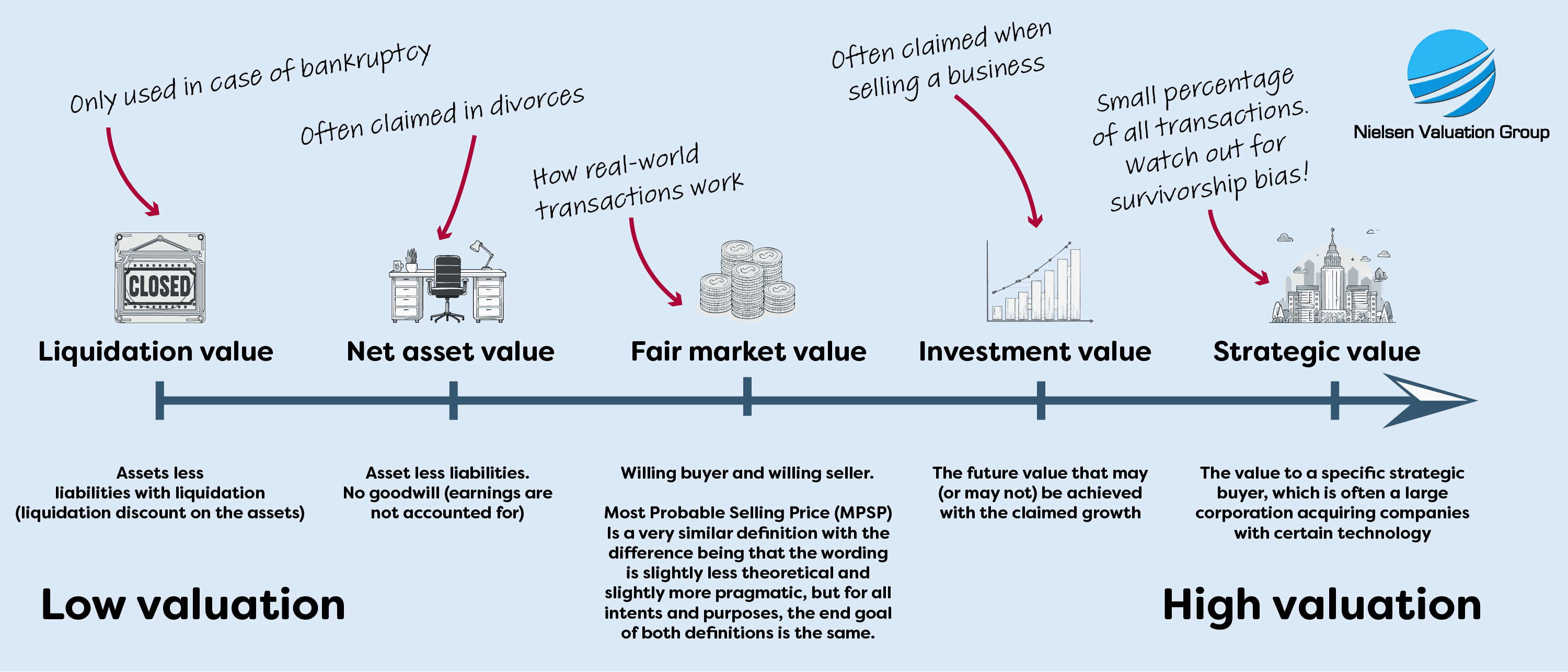

- Asset approach: The asset approach determines the net asset value of the company at market price after deducting all liabilities.

- Income approach: A very common approach that uses cash flow or earnings as the basis for valuation.

At Nielsen Valuation Group, we often use a combination of approaches. Typically, we will perform a balanced income approach valuation based on historical earnings and then combine it with an asset approach valuation to take into account the value of the assets.

When we use multiple approaches, we combine them judiciously, as opposed to weighting them mathematically. This is also consistent with what the IRS defines in its ruling:

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“

Sometimes a discount rate for lack of marketability is required. This is the case when there is reason to believe that the business could not be easily sold in the market, for example, if it is distressed or in liquidation. We never use standardized or theoretical frameworks for our calculations. Instead, we look at what rates are being used in similar real-world transactions in Los Angeles.

100% Customized Valuations

We always provide fully customized business valuations. This means that we take full account of your needs as a client, the purpose of the valuation and the nature of the business being valued.

We offer a free 30-minute consultation, which gives you the opportunity to express your needs and ask any questions you may have. This is an important opportunity for us to form an opinion about the business in question and the scope of the valuation. After our meeting, we will provide you with a customized proposal.

We strongly believe that you should never pay for aspects of a valuation that you do not need. Therefore, customization is important to us, as is our approach of never filling our valuation reports with “fluff”, copy pasted from a standardized template.

What is the Value of My Business in Los Angeles?

Are you planning to sell your Los Angeles business? As a business owner, you are probably attached to your business and know it inside and out. However, most business owners find it difficult to decide on a price.

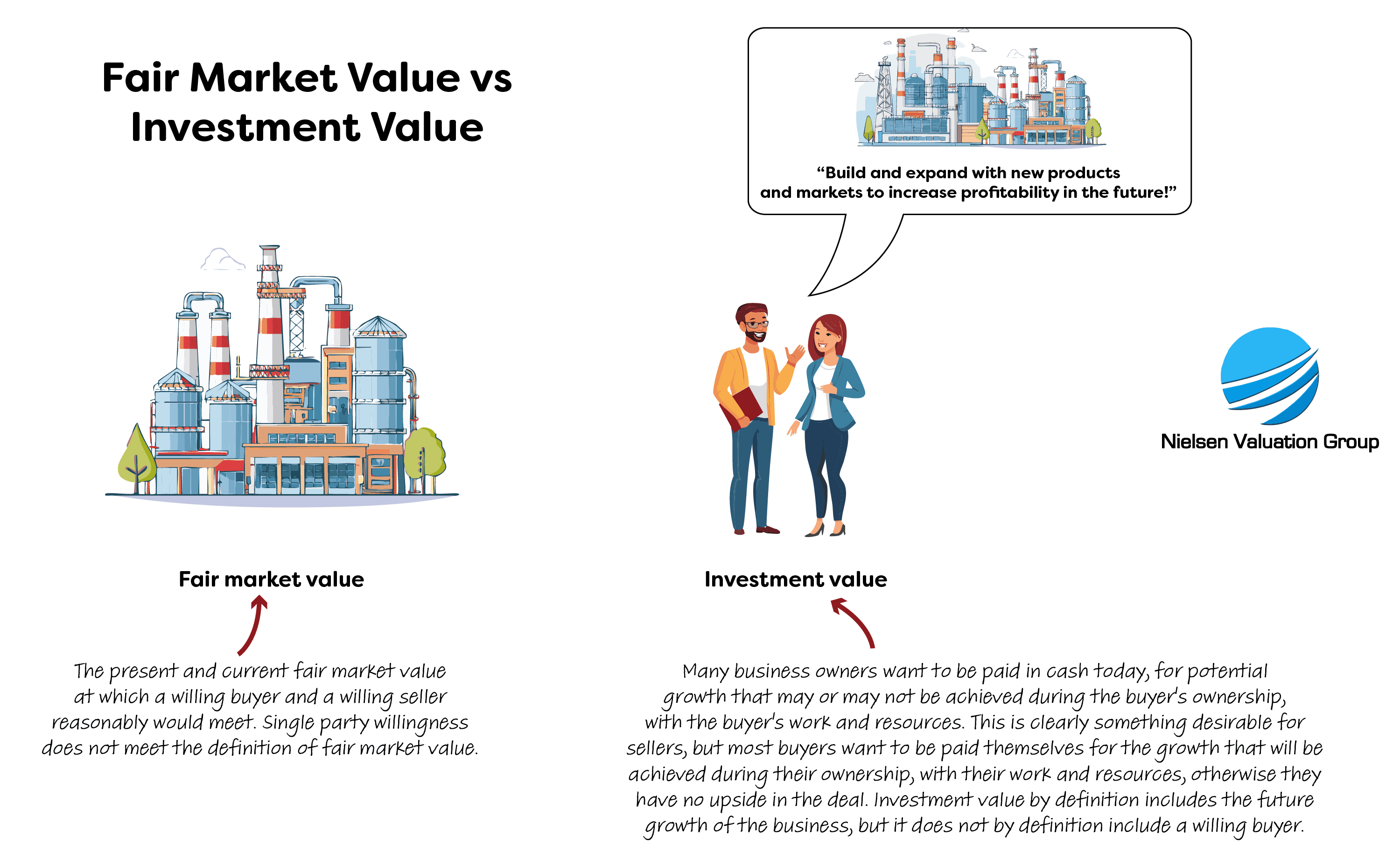

What a business is worth is ultimately the price that you and a buyer can agree on. This is called fair market value.

Most appraisals out there come up with a value that is far from fair market value. As a seller, there is no advantage to having your business overvalued. It will only make it harder to find a buyer and make negotiations more difficult.

When you use Nielsen Valuation Group for your Los Angeles business valuation, we will provide you with an estimate that is as close as possible to what can be considered fair market value, giving you a good starting position in your search for a buyer.

We would like to share with you two misconceptions that sellers often have. Knowing them can also help you better price your business.

The first concerns potential. Many business owners want to be paid for unrealized potential in the business. However, buyers never pay for potential because future profits are their reward for the risk they take and the time and energy they invest in the business.

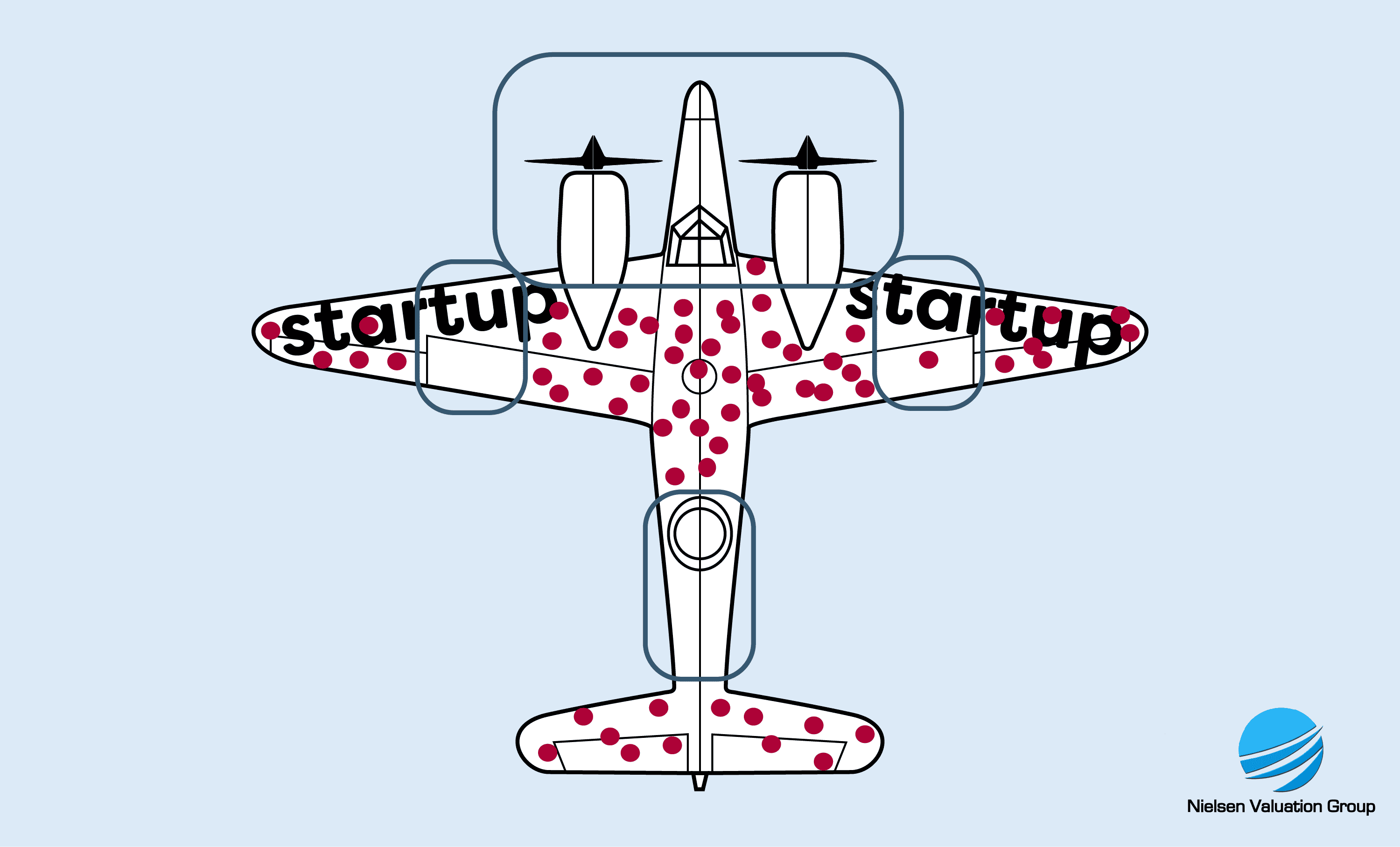

The second misconception concerns long-term risk. Sellers, especially those of startup companies, often suffer from survivorship bias. They point to the valuations of all the successful startups and unicorns and argue that there are similarities to their business. However, buyers and investors know the reality that there is a 1 in 10 chance that a given company will survive in the long run, which they take into account when they make their bids.

Survivorship bias: A term coined after World War II when analysts wrongly concluded that armor reinforcements were not needed around the engines and cockpit of aircraft. They had studied damage to planes returning to base after a mission. The conclusion was wrong because they only saw the survivors. The planes that were hit in the engines and the cockpit had crashed. Today, many startup owners make the same mistake when they point to successes like Meta, Spotify, or Alphabet.

Let Us Do Your Business Valuation

Nielsen Valuation Group provides unbiased, IRS Revenue Ruling 59-60 compliant Los Angeles business valuations, supported by the dynamics in real-world transactions. Contact us today for a free 30-minute consultation.

FAQ – Frequently Asked Questions

When will the appraisal be ready?

Most appraisals take 5 to 15 days to complete. Please let us know if you need faster service and we will do our best to accommodate your request.

How much does an appraisal cost?

The price depends on the size and complexity of the company and the purpose of the valuation. For example, a simple verbal valuation will be less expensive than a detailed valuation report to be used in a transaction or in court.

Can you value all types of businesses?

Yes, we do all types of valuations except for start-ups.

Do you conduct site visits?

Yes, we are happy to visit the business in Los Angeles to conduct a site visit and/or interviews. We can also visit companies in other parts of California.

Is the report admissible in court?

Yes, if you tell us the purpose of the valuation, we will make sure that the report meets all requirements for legal use. We can also present our findings in court if you like.

What type of business valuation services do you offer in Los Angeles?

We provide business valuations in all types of situations except for pure startup cases. You can use our valuations for, among other things:

- Buying or selling a business

- M&A and investments

- Buy-sell agreements

- Partner or shareholder buyouts and disputes

- ESOP

- Business restructuring / liquidation

- Tax purposes

- Divorce

- Estate planning

- Litigation

- And more!

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence