Your Unbiased Business Valuation in San Diego

Business valuations that comply with Revenue Ruling 59-60 and are designed to reflect real-world transactions

Unbiased Business Valuation in San Diego

We provide non-speculative and unbiased business valuation services in San Diego CA that are fully compliant with IRS Revenue Ruling 59-60. We always place great emphasis on the facts on the ground to determine fair market value, and we never use pre-determined formulas. Contact us now for a free 30-minute consultation.

- We always use the perspective of real-world buyers

- No predetermined formulas

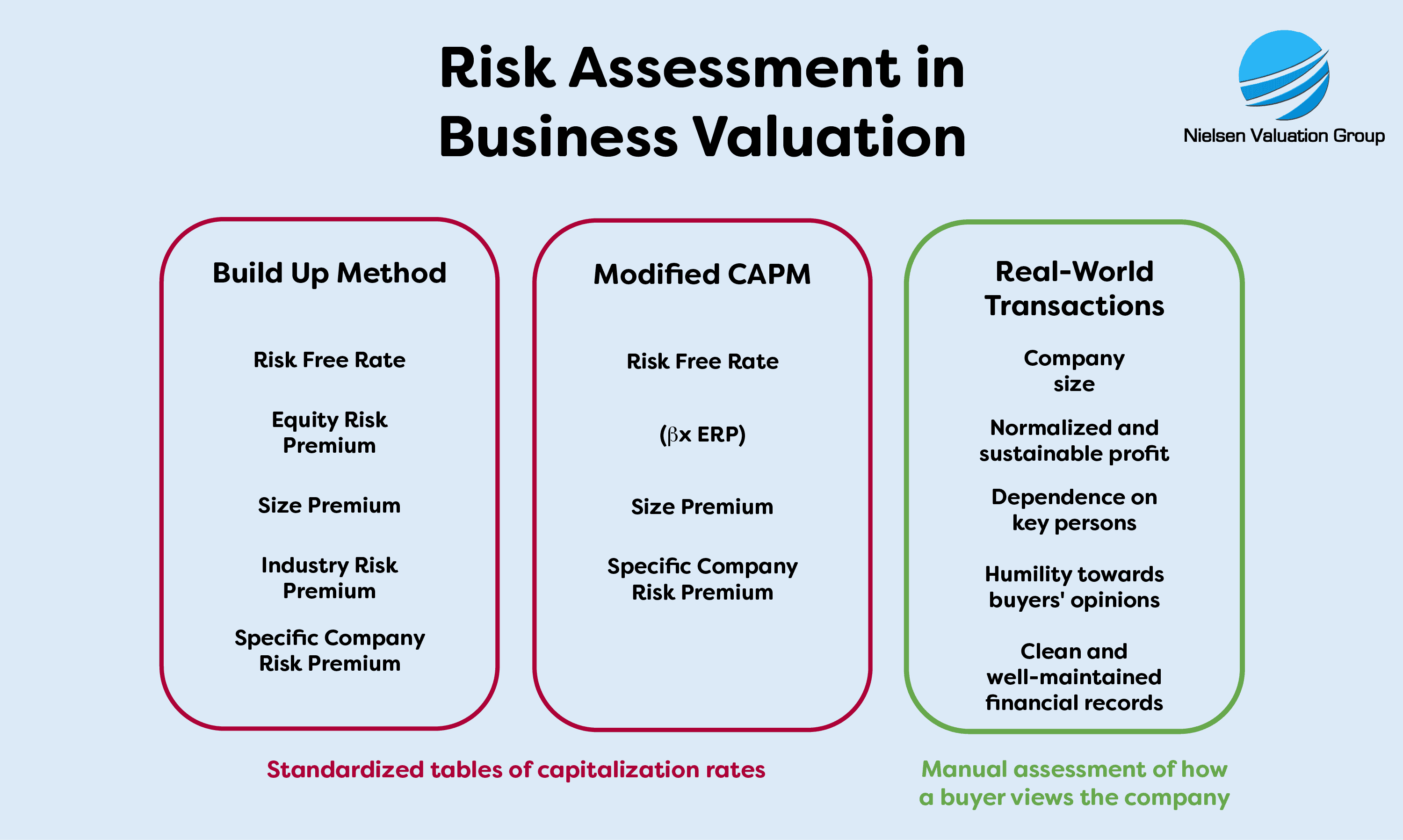

- We do not use standardized capitalization rate tables

- Compliant with IRS Revenue Ruling 59-60

- Emphasizing precedents and case law

Why Use Nielsen Valuation Group for Your Business Valuation in San Diego?

We are your trusted partner when you need an unbiased business valuation in San Diego California. All of our appraisals are fully compliant with the Internal Revenue Service (IRS) Revenue Ruling 59-60.

We will provide you with a sound and balanced valuation based on the actual condition of the business with the goal of determining its fair market value.

Our valuations take into account how real transactions work. We never use predefined formulas, speculate or take other shortcuts.

What you get is a credible valuation that will stand up to the scrutiny of your counterparty, whether in a transaction, in court, or in any other situation.

Below, we outline what makes our business valuations different.

We Are Fully IRS RR 59-60 Compliant

IRS Revenue Ruling 59-60 is an excellent indicator of how business valuations should be conducted.

The ruling says, among other things, that appraisals need to take the actual situation in the company into account. One has to do the hard work of finding out what is going on there in order to determine the fair market value. The dynamics in real world transactions is the guideline.

One should not take shortcuts such as using predefined formulas, standardized tables of capitalization rates, or applying arbitrary averages on earnings.

Here are some interesting quotes from the ruling that support those claims:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

However, you would be surprised at how many San Diego business valuation companies never mention this ruling or adhere to its principles.

At Nielsen Valuation Group, we fully adhere to this ruling. We uncover the company’s true condition and thoroughly evaluate its performance and prospects. In doing so, we reveal the fair market value. As a client, you benefit by knowing that the valuation is truly fact-based and credible.

We Understand the Importance of the Normalization of the Financial Statements

In a business appraisal, the calculation is the easy part, no matter how complex the calculation may be. It is the preparation that takes time and expertise.

We can compare it to a paint shop. The prep work takes time and must be done well. Applying the paint is also important of course, but it is the final touch. Without the prep work, the result will not be satisfactory.

In business valuation, the “prep work” is called financial statement normalization. It consists of two parts:

- The balance sheet: Because the value of assets on the balance sheet is book value, not market value, it must be adjusted. We are more interested in the market value of assets in a business valuation. Liabilities may also need to be adjusted.

- The income statement: Often include unrepresentative expenses or income. There may be occasional sales that are not representative of the business, such as the sale of assets. Or the owner(s) may have used business funds for personal expenses. Just to mention a few examples.

Once we have normalized the balance sheet and income statements, we have “clean data” as input for our calculations. This is a prerequisite for determining the fair market value. Without clean data, the valuation risks being off target.

We Select Valuation Approaches Carefully

Some San Diego business valuation firms use a standard approach to all of their valuations, regardless of the size of the business, the industry, or the purpose of the valuation. For example, it is not uncommon to simply perform a discounted cash flow valuation regardless of the situation.

This is wrong because such a valuation will not show fair market value.

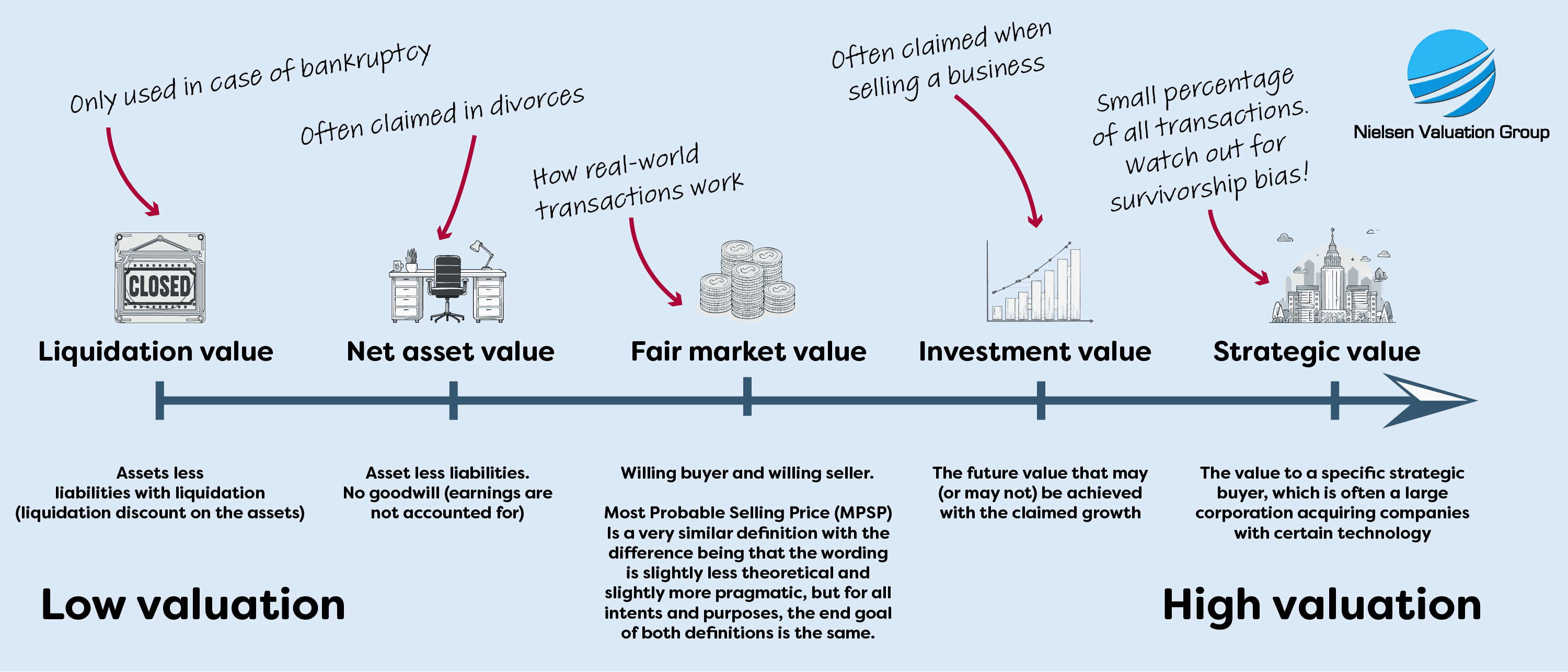

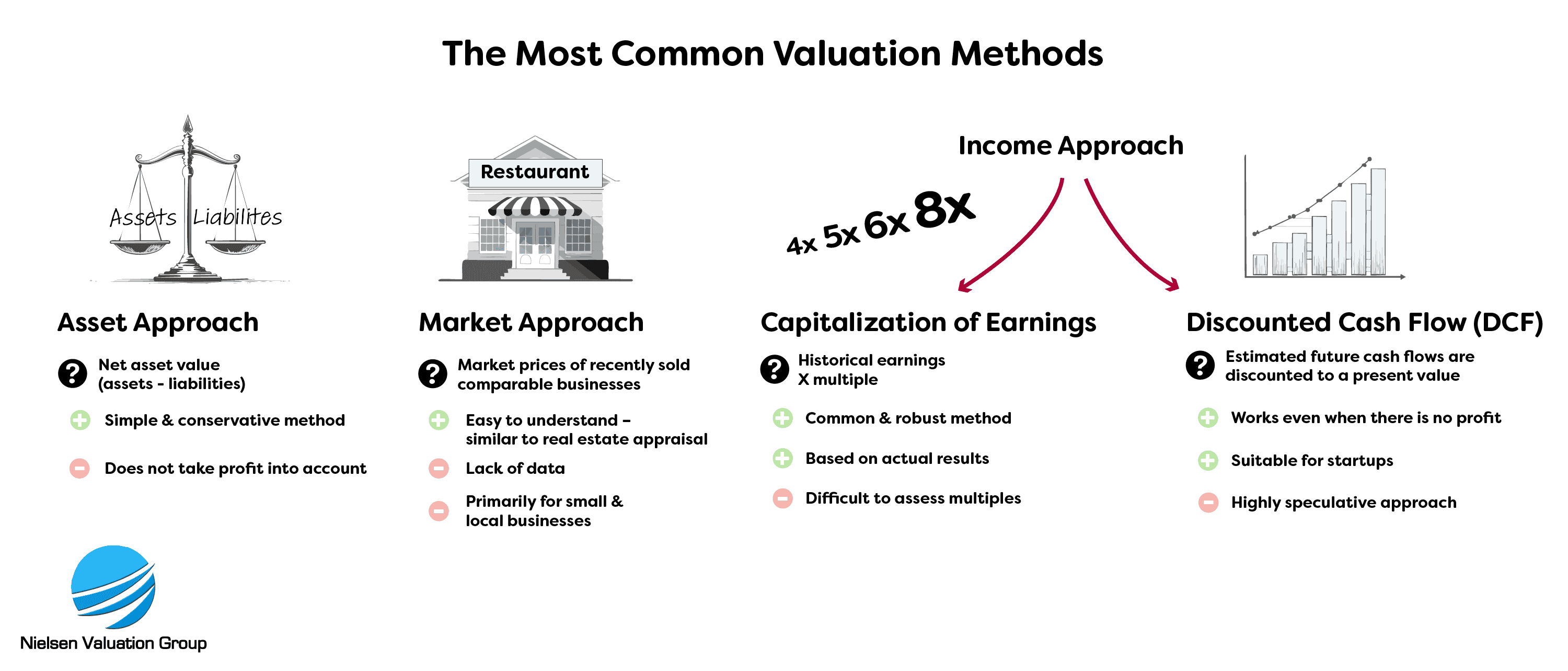

There are three main valuation approaches to choose from:

- Market approach: Looks at what similar businesses in San Diego have sold for. A very efficient approach if enough data is available.

- Income approach: Uses cash flow or earnings to estimate the value of the business.

- Asset approach: Based on the market value of the assets after deducting liabilities.

In most cases, we perform an income approach valuation in combination with the asset approach. In doing so, we consider both income and the net value of assets, which is what is typically done in real world transactions.

We combine methods as opposed to weighing them. Our approach is supported by the IRS ruling:

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“

If the business we are valuing is distressed or will be liquidated, we apply a discount rate for lack of marketability. When doing so, we calculate the discount rate based on the actual situation and with respect to how transactions work, rather than using a theoretical reference.

Customization is Important to Us

When you hire Nielsen Valuation Group for your San Diego business valuation, you will always receive a 100% customized valuation.

There is no one-size-fits-all approach to business appraisals. Our competitors know this, yet many overcharge you for services you do not need, or provide a valuation that is off the mark because it has not been properly customized for the situation.

We encourage you to take advantage of our offer of a free 30 minute consultation. It allows us to get to know you and your business better and to understand why you need a business valuation. Feel free to ask any questions you may have. After our meeting, we will provide you with a customized proposal.

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.” IRS RR 59-60

What is My San Diego Business Actually Worth?

Are you thinking of selling your San Diego business? Keep in mind that you will not benefit from an overly optimistic valuation. Instead, you will benefit from a down-to-earth, fair market valuation that reveals the true value of your business. It will help you gain the confidence of potential buyers and make your business more attractive in the market.

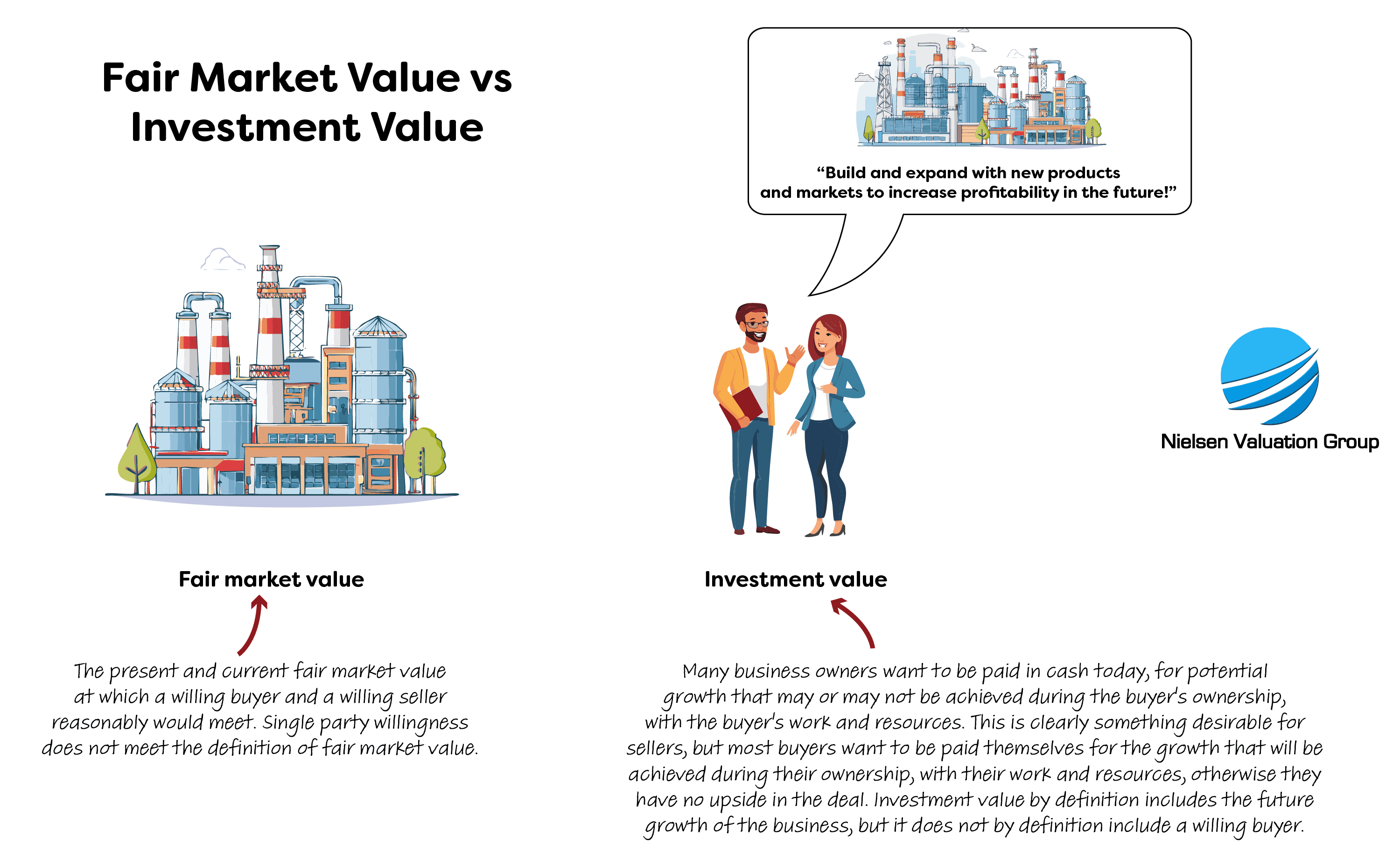

“Define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. Court decisions frequently state in addition that the hypothetical buyer and seller are assumed to be able, as well as willing, to trade and to be well informed” IRS RR 59-60

We would also like to share with you two common misconceptions that many sellers of businesses have.

The first is the belief that potential should be included in the valuation. As a business owner, you are probably emotionally attached to your business. You may feel that it has tremendous potential if certain things are done. However, a buyer will not pay for that potential. Buyers pay for the current situation and track record. They see the realization of any future potential as a reward for the risk they take and the time they invest after buying your business.

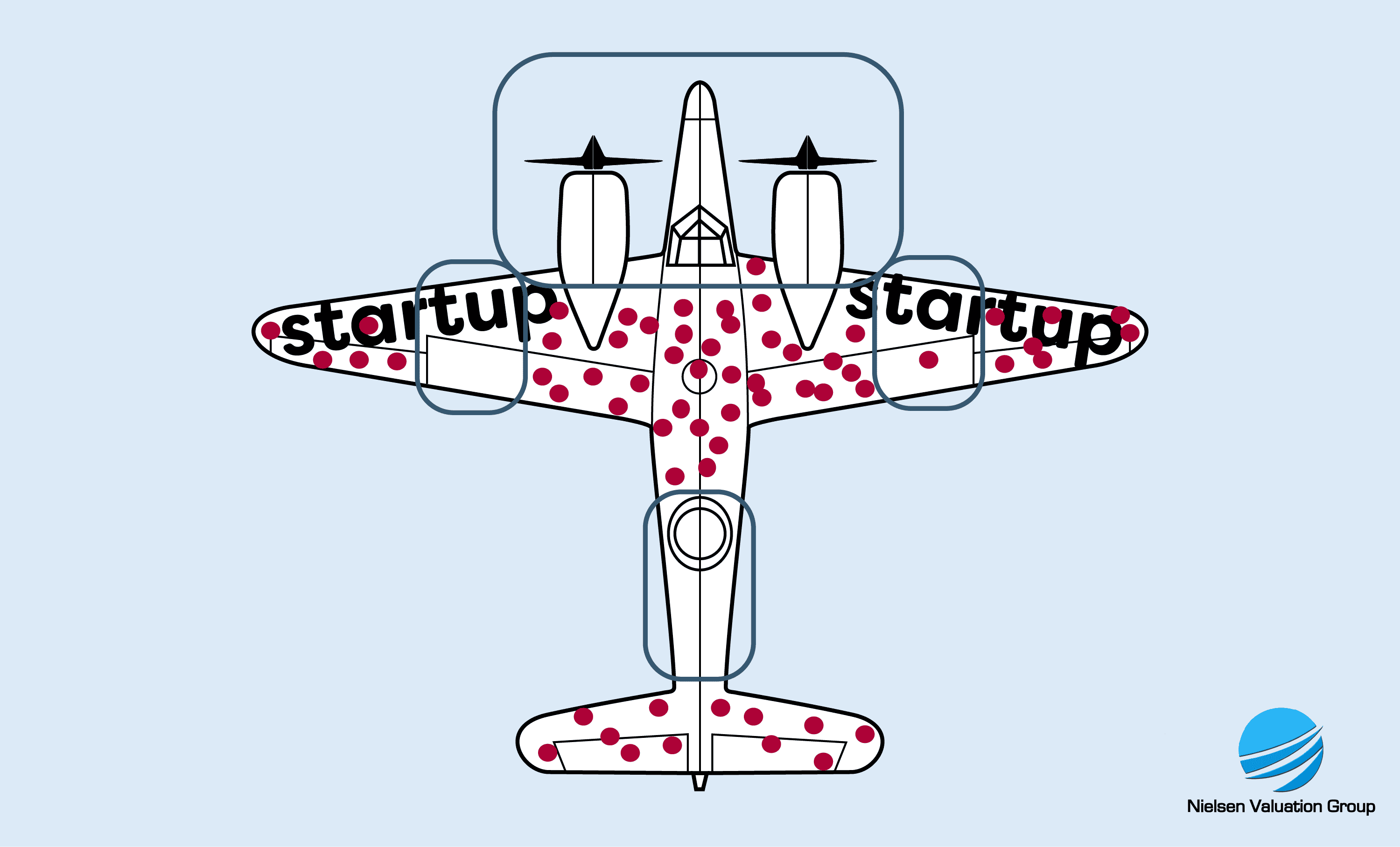

The second misconception has to do with the risk of the business and its long-term prospects. Many sellers point to successful startups and argue that their business is bound to follow a similar trajectory. However, the buyer or investor knows that only 1 in 10 companies survive in the long run. Therefore, the price they are willing to pay will never reflect the valuation multiples of successful startups.

Again, a fair market valuation will help you get the numbers right and put you in a strong negotiating position before selling your business.

Our second example of misconceptions among sellers of businesses can be explained with two words: survivorship bias. The term comes from World War II, when analysts mistakenly concluded that airplanes did not need armor reinforcements around the cockpit and engines. The conclusion was based on planes that returned to base and showed no signs of damage in those areas. The reality was that the warplanes that were hit there had crashed. Similarly, many business owners see only the successes and not all the businesses that have failed along the way.

We Can Help You with Your Business Valuation

Nielsen Valuation Group provides unbiased, IRS RR 59-60 compliant business valuations in San Diego, grounded in real-world transactions. Contact us today for a free 30-minute consultation.

FAQ – Frequently Asked Questions

When can I expect to receive the valuation report?

We typically deliver your valuation within 5 to 15 business days. If you are in a hurry, we may be able to accommodate a faster delivery.

How much does it cost to do a business valuation in San Diego?

The price varies from case to case and depends on factors such as the size and complexity of the business and the purpose of the valuation. Contact us now for a free consultation and personalized quote!

Can I use the valuation in court?

Yes, you can. We have successfully helped companies and individuals with business valuations for litigation or other legal purposes that have helped them in their case. Please let us know so that we can provide you with an appropriate quote.

Do you do all types of business valuations?

Yes, we do all types of business valuations except for startup companies.

In what situations can I use your business valuation services?

We can help you with most situations that require a professional appraisal, including but not limited to:

- Buying or selling a business

- M&A and investments

- Buy-sell agreements

- Shareholder / partner buyouts

- ESOP

- Business restructuring, liquidation

- Shareholder or partner disputes

- Divorce

- Tax purposes

- Estate planning

- And more!

Christoffer Nielsen

Experienced expert in business valuation, litigation and transactions

[email protected]

(737) 232-0838

Want to go with a cheaper option or even do the valuation yourself?

Nothing is stopping you, but...

You may lose the lawsuit, due to the valuation failing to be waterproof.

You may never settle the conflict, hurting the relationship with your counterpart.

You may get deceived while entering or exiting your partnership.

Tell us how we can help you

Personal service & IRS RR 59-60 compliant valuations – reach out with confidence